The last few years have seen some of the biggest changes the pension industry has ever seen. Rules for those with defined contribution pensions have changed almost beyond recognition and so the Final Salary Pension Rules have had to change to keep pace.

Final Salary pension rules are different to defined contribution pension rules and changes that came into effect in 2020 will continue to affect those with defined benefit pensions into 2021 and beyond.

The new rules for Defined Benefit pensions have been introduced by the Financial Conduct Authority in order to protect Defined Benefit pension holders and to stem the flow of people transferring out. In essence the changes make it more difficult and more expensive to transfer your final salary pension.

Final Salary Pensions & New Rules

In April 2015 sweeping changes to the pension industry have made the idea of transferring out of a Final Salary Pension Scheme much more attractive. The most radical changes to private pensions for a generation were brought into force, meaning that those with private pensions had much more freedom and choice in how they accessed their pension.

Many, but not all, of the changes to pension rules, are linked to the 2015 pension freedoms. Knowledge and understanding of the impact of these changes is still limited across most of the population. We examine these new rules and how they could affect Final Salary Pension holders…

Final Salary Pension Rules around transfer advice

Many of the Final Salary Pension rule changes relate to the advice that is being given surrounding transfers. With increasing transfer values, there’s increased temptation and motivation to transfer a defined benefit pension.

There’s been historic poor practice in the industry and the FCA brought in the following changes to address it:

1. You Must Seek Regulated Advice if Your Transfer Value is Over £30,000

If you are considering a Final Salary Pension Transfer and your pension pot is worth more than £30,000 you must seek professional advice from a regulated financial adviser, they also need to be a qualified pension transfer specialist. Pension Transfer Specialists have in-depth and up-to-date knowledge of final salary pensions and new rules affecting them, they’ll be able to explain your options to you as well as any risks or benefits involved.

Your scheme provider will not transfer your funds without proof that you have obtained this advice.

There is a good reason for this requirement. The decision whether or not to transfer out of a Final Salary Pension Scheme is not one that should be taken lightly.

Pension Transfer Specialists have in-depth and up-to-date knowledge of final salary pensions and new rules affecting them

Final Salary Pension Schemes are extremely valuable and many people do not understand the true value of the asset they have. A guaranteed, inflation-protected, income for life, especially with people living for longer, is not something to be sniffed at and is often worth much more than people realise.

Beyond the cash equivalent transfer value, there are often other benefits – like a protected retirement age or death benefits that also need to be considered.

And then there’s the element of Risk. Moving from a Final Salary Pension scheme to a private pension brings with it an element of risk and added responsibility. Your pension is no longer managed and invested by your pension scheme administrators and benefits are no longer guaranteed. You’ll need to invest your pension fund to provide yourself with a future income.

A full pension transfer analysis is incredibly in-depth and will take many hours of work by a qualified specialist. You will need to pay for this advice. Please note that fees vary from firm to firm.

For full details of what you should be thinking about before you transfer, we recommend reading 4 key things to consider before you transfer your Final Salary Pension .

2. Contingent Charging banned for Final Salary Pension Transfers

Historically, Pension Transfer Specialists could offer advice on pension transfers without charging upfront.

If you were considering a transfer you could request transfer analysis and a report and you would only pay for the advice if you decided to go ahead. This is known as ‘contingent charging’, the fees being contingent on the work being carried out.

The Financial Conduct Authority FCA took the view that this approach could encourage firms to recommend people transfer, since they would only get paid when they do.

With a ban on contingent charging, you are now required to pay for any advice you receive upfront, regardless of whether you opt to transfer or not. And due to FCA rules, firms must charge the same amount, whether you are transferring or not.

So even if you don’t transfer your pension, you’ll have to pay for the advice and work as if you have.

Fees for Final Salary Pension Transfer Advice are significant since it can only be carried out by a Pension Transfer Specialist and the work is considered high-risk by insurers.

3. Personal Recommendation to Transfer

Following a lengthy consultation the Financial Conduct Authority have updated guidance on pension transfers and now require all advice to be a personal recommendation, which means the advisor is responsible for the advice they give you.

This means a financial advisor needs to carry out full analysis before recommending any transfer and they are responsible for the advice they offer.

This rule change has forced poorly performing firms to offer more comprehensive analysis and advice. If you feel you have mis-advised you will also have recourse through the Financial Ombudsman.

This single change to Final Salary pension rules changed the industry, with insurers fearing another PPI style scandal and pulling out of the market. Many firms could no longer get cover and so were forced out of the market leaving fewer qualified firms to offer pension transfer advice.

Those left in the market faced greatly enhanced premiums (some firms have seen premiums multiply ten-fold) and prices for this kind of work have had to increase to cover the increased cost and risk to the firm.

4. Self Managed Investments after Final Salary Pension Transfer

Another of the big concerns raised by the FCA during their Defined Benefit Pension consultation was the sheer number of individuals being advised to transfer their pension without being given any advice on how to invest the money afterwards to protect the value of their pension fund.

For this reason, a growing number of insurance firms are refusing to cover Final Salary Pension Transfers unless the firm recommending the transfer is also managing the fund after the transfer. So, if you are seeking to transfer your fund you may find fewer firms willing to recommend a transfer if you are wanting to self-manage your private pension afterwards.

With a growing number of insurers moving out of this area of the market many Financial Advice firms have already been forced to stop offering this service and you may find far fewer firms offering this as an option in the future.

Other Pension Rules affecting Final Salary Pensions

Some other pension rule changes, although not directly applying to Final Salary pensions, could still impact on you:

5. Access your Pension From 55

Without a doubt, one of the biggest changes to the pension industry is the new rule allowing anyone with a private pension access to their pension pot from 55. The changes opened the door to the prospect of early retirement for thousands of people across the UK. For those with a private pension, you can take just some or your whole pot in one go.

N.B. It is important to note that withdrawing more than 25% of your pension fund will result in you being taxed at your marginal rate of income tax.

Individuals with a Final Salary Pension still need to wait until their scheme’s pensionable age before they can access their pension. In some cases, early retirement may be considered by your pension scheme administrator but your benefits will be adjusted and you may receive considerably less than you had previously been forecasted.

For those with a Final Salary pension considering early retirement, the new rules could make transferring to a private pension a more attractive prospect to give them early access to their pension savings.

Changes for those with a private pension mean you can take just some or your whole pot in one go from 55

6. Tax-Free Lump Sum Rules

The pension changes brought in in 2015 allow private pension holders access to a 25% tax-free lump sum from 55. Individuals can access this lump sum without needing to draw the rest of their pension.

So, if you have a defined contribution pension you can take your tax-free lump sum at 55 and leave the rest of your pension invested until you retire. Defined contribution pension holders don’t need to take all of their tax-free cash in one go. You can take your tax-free cash in chunks over time.

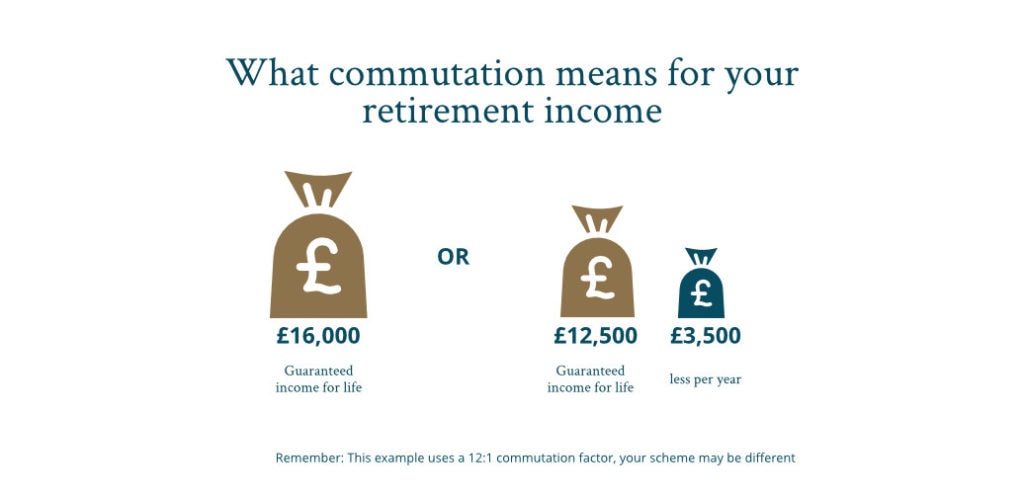

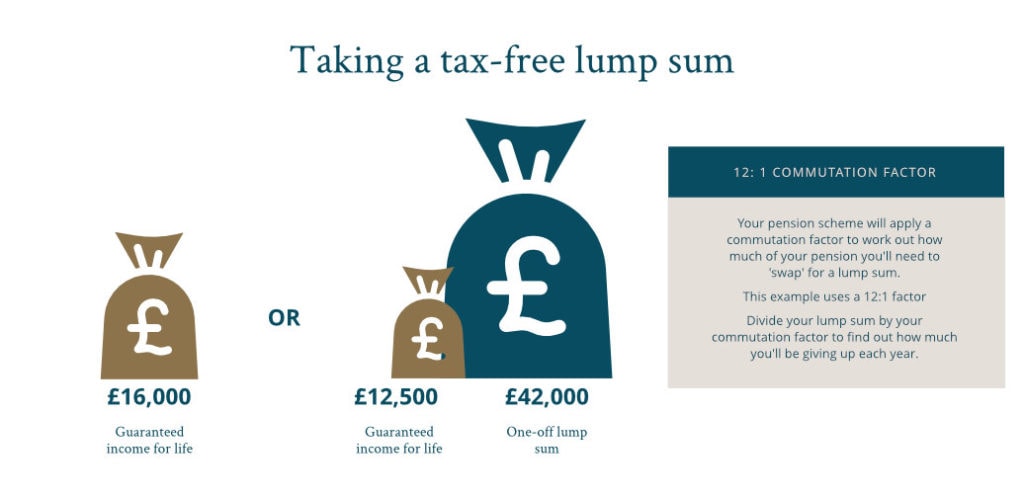

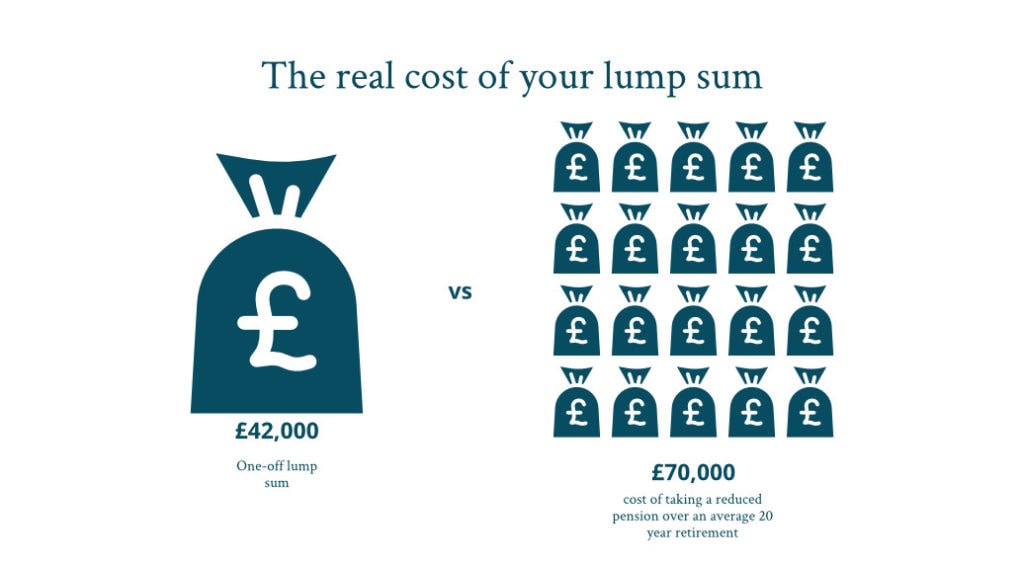

Tax-free lump sum for Final Salary Pension Holders

Most final salary schemes also allow pension holders to draw a one-off tax-free lump sum but you cannot take it in chunks, you need to take your lump sum all at once and normally the scheme pension must be taken at the same time.

It is worth noting that this lump sum is often offered at the cost of receiving a smaller starting pension. Sometimes, this lump sum is automatically offered in addition to your guaranteed pension income, but, it’s important to note that the calculation method used to determine how much you would receive often results in you receiving less than 25% of your pension pot.

So check first and make sure you understand the cost of taking this tax-free lump sum because once you have selected your choice of pension benefits, you will not be able to change your mind in later years.

7. Drawdown Limits Removed

From 6 April 2015, the limits on how much or how little you could take from your drawdown fund (see our drawdown calculator) each year were scrapped. Previously the amount you could take as income was capped at 150% of the income a healthy person of the same age could get from a lifetime annuity. Now, however, you are allowed unlimited withdrawals.

For higher earners the option of a flexible income offers them the opportunity to manage their income in a tax-efficient manner, taking less when they don’t need it and more when required. They can balance their income requirement with their tax-liability.

For individuals with a Final Salary Pension that takes them into the higher-rate tax bracket, the ability to access their money in a more flexible way may be advantageous for tax planning purposes.

8. Changes to the Lifetime Allowance

The Lifetime Allowance is a limit on the amount you can take from your pension without triggering an extra tax charge.

Under current tax rules, you can build up a pension fund worth £1,073,100 million over your lifetime, for both final salary and private pension owners. If the Lifetime Allowance is exceeded, an additional tax bill is payable from your pension pot.

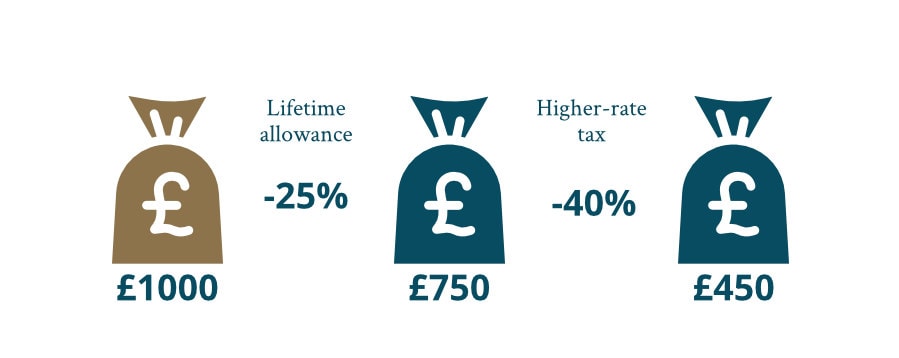

You’ll pay a flat-rate 55% tax on any lump sum you take from your pension once you are over the lifetime allowance. So for every £1000 you take over the lifetime allowance, you’ll receive £450.

If you take your pension as regular income withdrawals you’ll pay a 25% tax surcharge once you go over the lifetime allowance. So for every £1000 of income, you’ll pay £250 in lifetime allowance surcharge and then 40% tax on the remaining amount. After tax, you’ll receive £450.

How is lifetime allowance paid for defined benefit pensions?

For defined benefit pension schemes, your pension scheme administrator should pay the 25% tax to HMRC out of your pension pot, leaving you with the remaining 75% to use towards your retirement income. This will be collected at source by the pension scheme from day one of the pension payments.

Those with private pensions valued at more than £1.03m (or higher with protection) can defer the impact of the lifetime allowance to age 75.

This can be achieved by keeping withdrawals within the lifetime allowance limits up to age 75, thus gaining the benefit of a largely tax-exempt investment account until that date, when the surcharge tax will become due on the excess value of the fund – 55% if taken as a lump sum or 25% tax if taken as income. Read more here

9. Changes to Inheritance Rules for Private Pensions

Changes to Inheritance tax rules in October 2014 brought greater flexibility over who can inherit your pension. Private Pensions in drawdown can now be left as a legacy to any beneficiary that you nominate. They do not have to be your spouse or civil partner, opening up the doors to leave a tax-free legacy to adult children, siblings or grandchildren.

Your beneficiaries could receive either a lump sum on your death or they can inherit your drawdown plan as their own pension pot.

‘Inherited drawdown’ allows your beneficiaries to take out as much or as little as they need, when they need it, without having to wait until they retire.

If you die before the age of 75 and your beneficiary takes the money within 2 years the money is tax-free. If you die over the age of 75, your pension provider will deduct income tax from anything they take.

Important Note:

If you have taken some or all of your savings out of your pension – e.g. to put into a bank account or another type of investment– that money then becomes part of your estate and could be subject to inheritance tax. This includes anything left unspent from your pension tax-free lump sum.

Your private pension could now provide a tax-free inheritance for your loved ones

How Do These Inheritance Rule Changes Affect Final Salary Pension Holders?

The rules that govern what happens to your final salary pension when you die are different and you cannot pass your wealth on in the same way.

When you die your scheme may pay a reduced pension to your spouse but you are not able to pass on the full value of your pension. They will not normally be able to take the money as a lump sum and you normally cannot nominate an adult child or another beneficiary.

If you are unmarried, it is important to know that when you die your Final Salary Pension is absorbed back into the scheme for the remaining members. You cannot pass the money on.

It is this change that has made many consider transferring out of their Final Salary Pension. Although, it is important to remember that there are often ways to retain the benefits of a Final Salary Pension, i.e. remain within the scheme, and to implement plans to pass on wealth in other ways i.e. you could consider a life insurance policy.

N.B. Death benefits vary from scheme to scheme, always check with your pension scheme provider for details of the rules applying to your scheme.

10. Pension Protection Fund Limits

The Pension Protection Fund has been highlighted in the press with the collapse of BHS and the British Steel Final Salary Pension fund. There is much fear-mongering surround the collapse of Final Salary Pension Schemes with people wrongly assuming that they could lose all of their pension savings. The reality is that you need to have a pension pot of over £2million before you start missing out significantly.

The PPF was set up in April 2005 to protect those with Final Salary Pension if their employer goes bust and its pension scheme can no longer afford to pay their promised pension.

As of 1 April 2018, if your Final Salary Scheme goes bust and if covered by the Pension Protection Fund, they will pay 90% of the value of your pension up to a maximum limit. The payments will rise in line with inflation (up to a maximum of 2.5% per year).

If you have already retired and are claiming your pension, and/or you were/are over the scheme’s normal retirement age at the time the scheme went bust the Pension Protection Fund will generally pay 100 per cent of what your pension scheme was paying you. The payments will also rise in line with inflation (2.5% maximum applies here too).

Final Salary Pensions and New Rules: Summary

The changing landscape for pensions has opened up many possibilities for those considering a Final Salary Pension Transfer, but it is essential to get the right advice based on your personal circumstances and to consider the benefits and risks as they apply to you.

If you’d like to speak to a pension transfer specialist, contact us to schedule a free initial call.