Now that you can access your pension from the age of 55, you might be wondering if you can retire early. The Pension Freedom changes may have put early retirement within reach, but can you afford to do it? Exactly how much do you need to retire at 55?

According to the UK’s Centre for Research in Social Policy, the minimum recommended income in retirement is £16,996 a year so if you retire at 55 you’ll need at least £186,956 to last until your state pension kicks in at 66.

But that’s based on the current state pension age, and some of us won’t receive our state pension until we’re 68.

It’s also assumes you’ll be comfortable living on the minimum amount recommended for retirement, but if you’re hoping to enjoy a comfortable retirement experts estimate you’ll need between £16,996 to £44,000 a year.

So you could need anywhere between £187,000 and £484,000 to retire at 55, just to get you to state retirement age, You’ll still need to budget to top up your state pension once you get to state pension age.

So how much you need to retire at 55 really depends on the standard of living you want and when you’re due to receive your state pension.

It also depends on how you plan to fund your retirement.

If you plan to fund retiring at 55 from existing investments, property rental income or a passive income stream, then you might not have to build up such a large pension pot to provide an income.

How much pension do I need to retire at 55?

How much you need in your pension pot is decided by:

How much you need in annual retirement income (X multiplied by) The length of your retirement

Since we don’t have a crystal ball to know exactly how long you will live, we can work with some industry accepted assumptions to give us a strong foundation for a retirement plan. It can be helpful to use a life expectancy calculator, which works on averages based on gender and age.

We asked Simon Garber, our retirement planning specialist IFA – how much you’d need in your pension pot if you’re planning on investing your money and using pension drawdown to retire at 55, he said

“As a rule of thumb, for every £3-4K you plan to take in annual income, you’ll need about £100,000 in your pension pot. So if you opt to take £10K per year, you’ll want between £300-£400K in your pension pot.”

How to Fund Your Retirement at 55

There are a number of ways to fund your retirement at 55:

- Access your private pension from 55 – use flexi-access drawdown or buy an annuity

- Tax-free cash from your pension

- Rental income

- Dividends from a business

- Money from the sale of a business

- Money from the sale of a property

- Savings and ISAs

- A redundancy package

- A maturing endowment policy

- An inheritance

- Opting for a flexible working retirement or

- Part-time work – read 7 jobs you can do in retirement

Using your Pension Tax-Free Lump Sum

You also have the option at 55 to access 25% of your pension pot as a tax-free lump sum

If you do opt to take your tax-free cash from your pension, there are a couple of things to consider.

1) you’ll have less money invested to potentially grow for the future.

2) Once you’ve taken your tax-free cash you’ll be liable for tax at your marginal rate on the remainder of your pension pot. Find out how much you could pay with a pension lump sum tax calculator.

If you don’t need the money straight away you could leave the money invested in your pot and take advantage of 25% of your withdrawals being tax-free.

Click here to find out more about taking tax-free cash from your pension

What is a good retirement income?

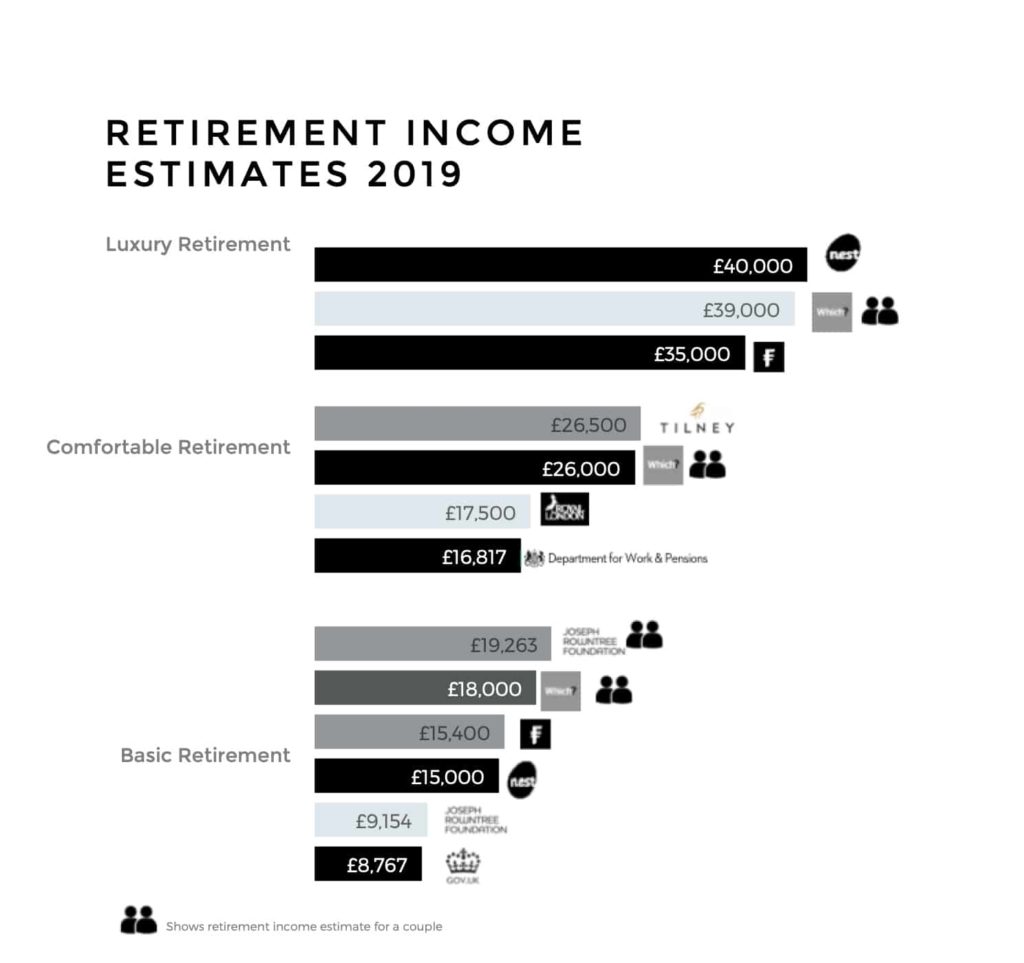

Estimates for what is a good retirement income vary wildly depending on whether you are a couple or single and how much you earnt before retirement. These ‘rules of thumb’ amounts are estimates based on averages and may not provide an accurate representative amount for you.

The minimum recommended income in retirement for 2023 is £16,996 for a single person and £26,113 for a couple. According to research by the Joseph Rowntree Foundation, this amount, after tax and benefits adjustments, is enough to cover what the public think is needed for a minimum decent standard of living.

By contrast, research by consumer group Which, place the cost of a comfortable retirement for a couple at £28,000 per year. A luxury retirement with long-haul holidays, gym membership and a new car every 5 years will set you back £44,000 a year.

Calculate your own retirement target by using our retirement cost calculators. Click here for singles and here for couples

Once you have a retirement income target in mind you can start to put your retirement plan together.

Using Safe Withdrawal Rate to estimate your Pension Pot Size

If you want to take an income through flexi-access drawdown from your pension or through income from an investment then you could use the 4% rule of retirement, also known as the 4% Safe Withdrawal Rate as a good rule of thumb. It loosely determines how much a retiree can safely withdraw from their pension pot each year without running out of money in retirement.

In theory, withdrawing 4% a year should provide you with a steady stream of income while also maintaining enough money invested in your pension pot to keep your income flowing through retirement.

Safe Withdrawal Rate theory is based on the results of the Trinity Study, published in 1998 by three professors of finance at Trinity University. The study looked at portfolio success rates over every 30-year period from 1926 to 1995 based on different withdrawal rates and portfolio allocations and concluded that 4% was a safe rate to withdraw

This approach is particularly helpful if you want to maintain the value of your pension to pass on to loved ones.

There are some flaws to relying entirely on Safe Withdrawal Rate as it assumes that your investment return is enough to cover inflationary increases and any investment fees and it doesn’t factor in any tax you may have to pay either, but it’s a useful starting point for individuals wanting to plan their retirement.

To work out how much you’ll need in your pension pot using a 4% safe withdrawal rate simply multiply your target annual income by 25

If we use the Which example for a comfortable retirement that states you’ll need £26,000 a year per couple, simply multiply that figure by 25 to see how big a pension pot you’re going to need

I.e. £26,000 x 25 = £650,000

Find your Safe Withdrawal Rate for Retirement

Using our UK Pension Drawdown Calculator you can see how likely it is that your Pension Pot will last you. It back tests against the last 100 years+ of UK financial market conditions including boom and bust years. It also allows you to select from a range of investment portfolios depending on your prefered level of risk.

If you plan to retire at 55 with a pension pot of £650,000 and we assume that you’ll live to an average age of 90. If your money is invested in a balanced fund and you opt to take a 4% annual income your pension pot would have been enough to last you in 68.1% of possible simulations. However, this does mean that in 31.9% of simulations your pension pot would have run out.

If you reduce your withdrawal rate to 3% a year however, your pension pot will still have a positive balance when you’re 90 in 97.5% of simulations run.

N.B.

Don’t forget that if you are eligible for the full State Pension, that will provide a guaranteed income for life once you reach state pension age – which may reduce your income needs from your private pension pot. Use our State Pension Calculator to see how this could affect your retirement savings.

How much do I need to Save to Retire at 55?

So how much should you be saving every month to retire at 55? Again, it depends on 3 main factors,

- When you start saving

- What investment return you can expect

- How much you currently have in your pension pot

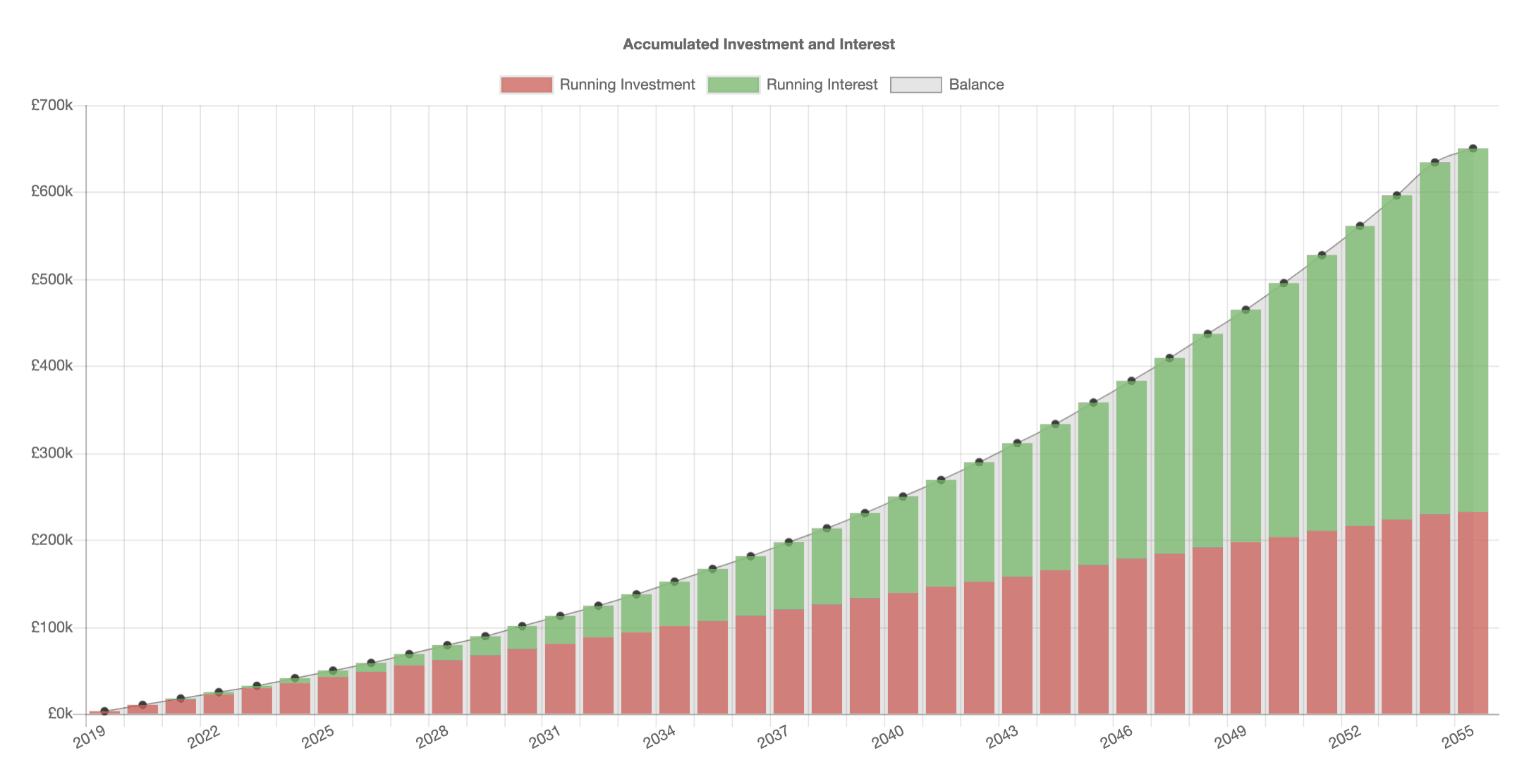

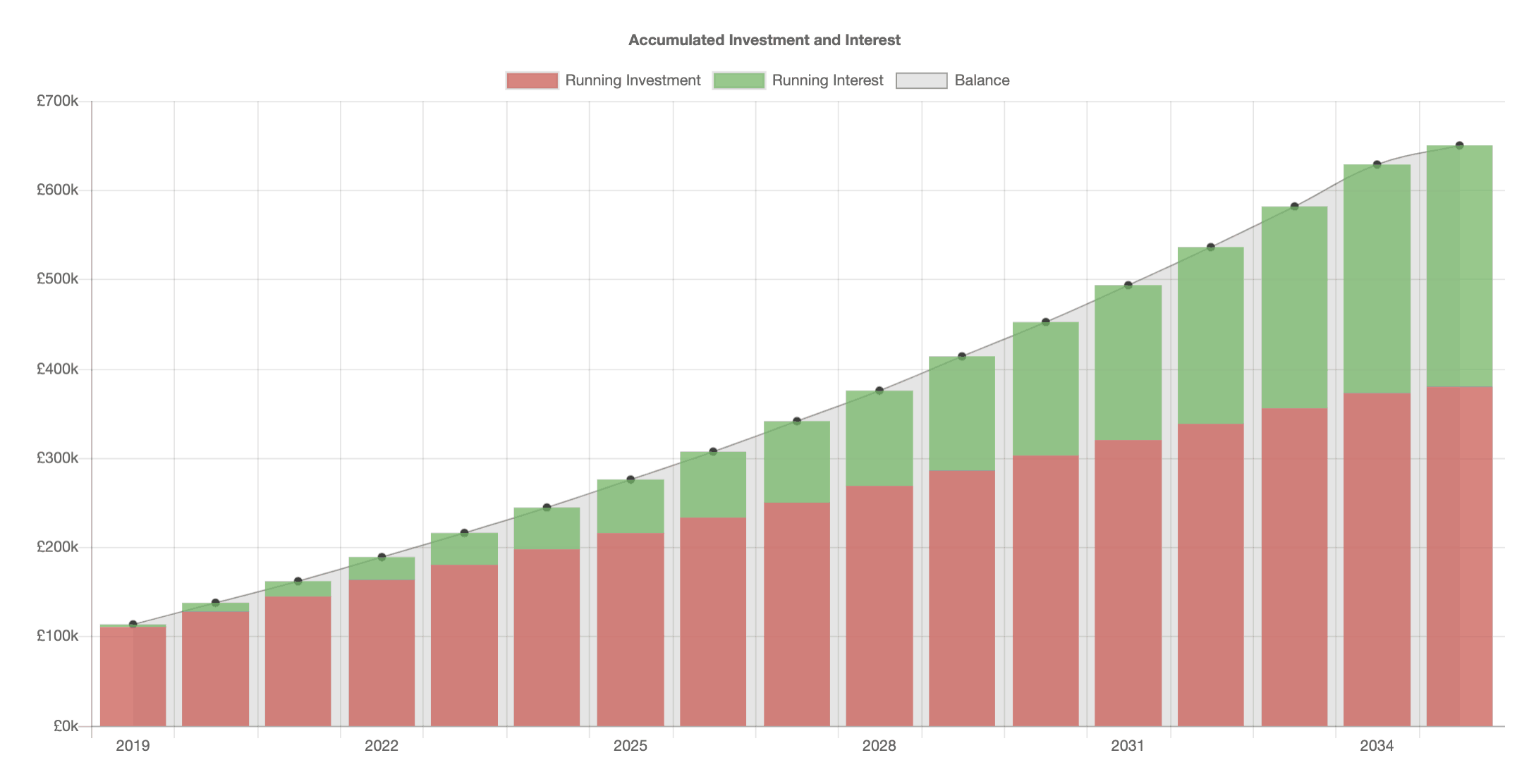

The earlier you start to save, the less you’ll need to save monthly and the more time you’ll have to benefit from compounding returns.

The higher investment returns you achieve, the quicker you can reach your retirement target, but you should be mindful that higher potential returns come hand in hand with increased risk. Investments can go down as well as up, so you need to be sure that your long-term investment strategy is one that you are comfortable with in terms of risk, and that it is designed to meet your goals – slow and steady wins the race!

Obviously, the more you have in your pension pot to start with, the less you’re going to need to save.

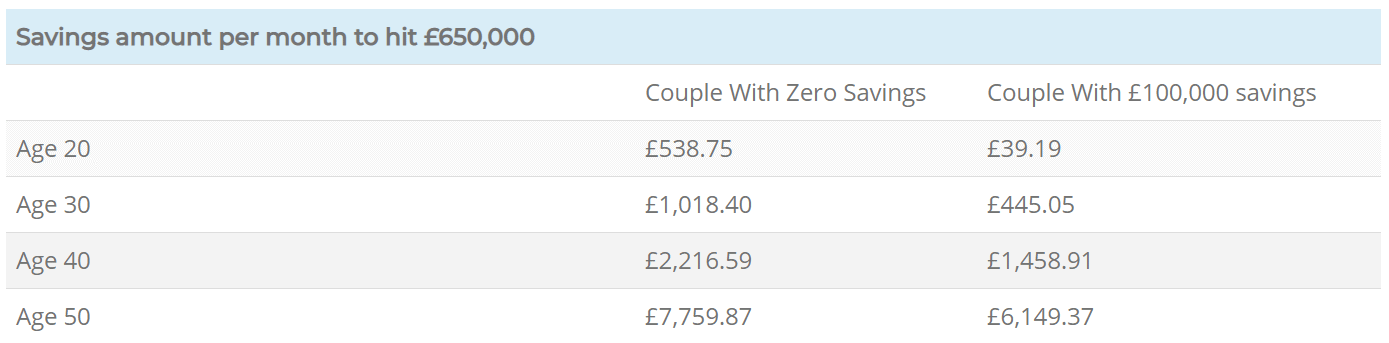

Example: Amount to save monthly to achieve a combined pension pot of £650,000 at 55. Assuming a 5% rate of return net of fees

This chart shows the amount a couple in their 20s, with no savings, would need to save per month to get a pension pot of £650,000 by the time they’re 55 using our example.

If you’re a couple in your 40s with £100,000 in your pension pot, you’ll still need to save £1,458.91 a month to hit your £650,000 retirement target by the time you’re 55.

As you can see, the earlier you start saving the better, it gets harder to make early retirement a possibility if you don’t start saving until your 50s, but it’s not impossible.

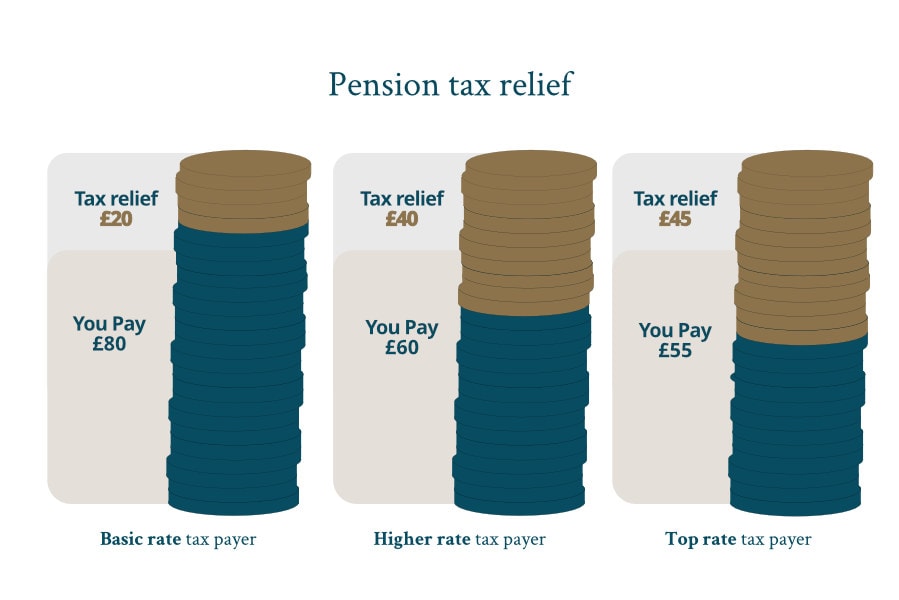

As a basic rate taxpayer, you’ll automatically get a top-up of 20% on your pension savings. If you’re a higher rate taxpayer you could get a 40% boost on any pension contributions by way of government tax relief equal to your highest rate of tax.

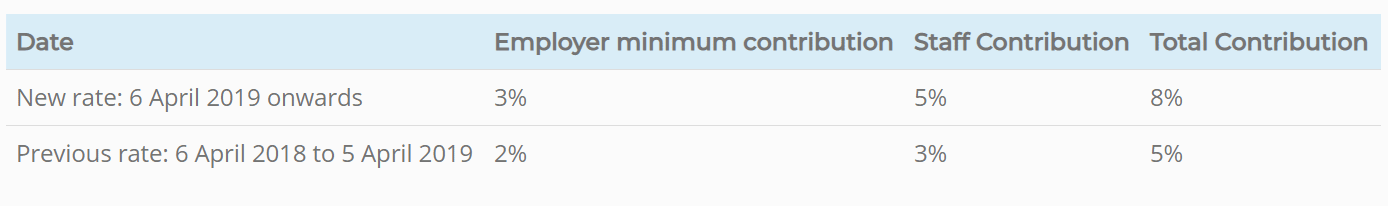

Plus, if you’re employed and qualify for auto-enrolment your employer is legally required to contribute to your pension as well – it might not be as hard as you think to meet your pension pot target.

Plus, if you’re employed and qualify for auto-enrolment your employer is legally required to contribute to your pension as well – it might not be as hard as you think to meet your pension pot target.

Click here and use our Pension Contribution Calculator to see how much you’ll need to save every month to hit your retirement target by your desired retirement age

Choosing a Guaranteed Retirement Income

If you want a guaranteed pension income in the form of an annuity, the cost will depend on whether you want a single or joint policy, whether you are a smoker or have any health issues and whether you want your income to increase in line with inflation.

For example, £100,000 would buy a couple a joint annuity policy of around £3,830.40 a year retiring at state pension age. But in the event that one of you dies it would provide 50% dependent’s pension on death. This amount is not adjusted for inflation, so the real value of your income will fall over time.

Early Retirement and the State Pension

If you plan to retire at 55, it’s likely you won’t be able to claim the state pension for at least 11-13 years. You can’t claim it early.

The current State Pension age is 66 rising to 68 for both men and women, if you plan to retire at 55, you’ll need to replace your entire pre-retirement income from the age of 55. If you’re born after 5th March 1961 – you won’t get your state pension until 67 and if you were born after 5th April 1968 you won’t get your State Pension until you’re 68.

Even when you receive your state pension, it’s unlikely to be enough to cover even basic living costs so you’ll still need enough money saved up to plug the gap between your state pension income and your cost of living.

Use our State pension Calculator to estimate what you’ll get in retirement

.

Factors that can affect retirement cost

Remember there are many things that can affect your retirement income needs and you may need to adjust as you go.

As a rule of thumb, you’ll need a bigger pension pot if:

- You have a low rate of return on your investments or you want to minimise risk in your investments

- If you retire early and increase the length of your retirement

- Your retirement income is indexed to inflation

- You’re not entitled to the full state pension

- If you don’t own your own home or you haven’t cleared your mortgage

- You have planned capital spending i.e. to buy a motorhome, home renovations, gifting money to help a child or grandchild buy a home etc.

- You are the sole breadwinner and therefore need more of a contingency

How much need in retirement will be largely dependent on your basic income needs with one of the biggest factors being whether you own your own home? It is estimated by Royal London that a third of retirees will eventually be renting and will typically need to find an extra £6,554 a year in retirement to pay private landlords, equating to a pension pot of at least £445,000 and that’s based on retiring at State Pension age, if you opt to retire early at 55, you’ll need to find a way to plug the gap between when you retire and when you receive your State Pension.

However, you can get away with a smaller pension pot if:

- You retire later

- You earn a higher rate of return on your investments

- You lower your income expectations at retirement

- You have alternative income streams (i.e. part-time work, passive income or property rental)

- You are able to downsize and partially fund your retirement with the equity

- You have a partner with a large pension that can provide for you both

- You are in poor health with a reduced life expectancy

Can I take my pension at 55 and still work?

If you haven’t built up a large enough pension pot to fully retire at 55, there may be another option. With the flexibility that the pension freedoms offer, there’s more than one type of retirement you can consider. Semi-retirement and/or phased retirement offer the freedom to take some of your pension early – whilst working part time, so you can enjoy some of the benefits of early retirement without running your pension pot down too early.

Read more: Can I take my pension at 55 and still work?

You should be aware that once you start to take an income from your defined contribution pension you will trigger the Money Purchase Annual Allowance, which limits the amount you can put into your pension and receive tax relief on.

It’s a complicated area, and one you should seek individual financial advice on if you’re thinking about working and taking your pension at the same time. It’s also worth speaking to an accountant to find out how much tax you could end up paying too.

Can I retire at 55 with £250K?

You can retire at 55 with £250k in the UK, but it’s only going to give you between £7,500 to £10,000 income a year. That’s if you stick to the recommended 3-4% a year safe withdrawal rate.

However, with the minimum amount you need to support a basic standard of living currently set at £9,609. Your max £10K a year doesn’t leave you a lot of wiggle room and it certainly won’t offer you a comfortable retirement.

If you can live on 10K per year. Great. But if your income needs are greater you might struggle. For instance, if you plan to take 50K per year your pension pot will be gone in around 5 years and you’ll still be at least 6 year’s off getting the state pension.

The problem with retiring at 55 with £250K is that, even though your state pension will kick in between 66-68, if you try and take more than 4% of your pension pot before this, you run the risk of it running out too soon.

It’s important that you do your homework before you make a decision and work out how much you’ll need in retirement.

Can I Retire at 55 with £300K?

If you want to retire at 55 with £300k in the UK, you could reasonably expect to take between £9-12K from your pension every year.

That’s assuming you stick to a safe withdrawal rate of between 3-4% a year.

However, even retiring with £300K, if you don’t want to run out of money you’ll have to make do with an income that only just about covers minimum income standards in the UK.

Of course, when your state pension kicks in you’ll be able to enjoy a higher income, but if you retire at 55 that could be up to 13 years away.

If you were hoping to enjoy a comfortable or even luxurious retirement, you’re either going to need to retire later, save more for your retirement or find another way to fund your retirement.

Can I retire at 55 with £400K?

£400K sounds like a lot of money but it might not provide you with the luxurious lifestyle you were hoping for if you plan to retire at 55.

If you retire at 55 with £400k in the UK, you could reasonably expect to take between £9-12K from your pension every year.

That’s nowhere near the £19,000 Which! suggest you’ll need as a single person to enjoy a comfortable retirement and less than half the amount a couple would need for a comfortable retirement.

It all comes down to the type of retirement you we hoping to enjoy.

Can I retire at 55 with £1million

Retiring at 55 with £1million could reasonably give you a sustainable income in retirement of between £30,000 to £40,000 per year if you stick to a safe withdrawal rate of between 3-4% of your pension pot.

Now, if you are expecting your full state pension to kick in at 66-68, you may be able to take a little bit more, but it’s important that you don’t take too much from your pension pot too soon as you could risk.

It’s best to speak directly to a Financial advisor, they’ll be able to run some cash flow models to show how your withdrawals might affect your pension pot over time.

Need help making your early retirement dreams a reality?

We have a number of retirement planning articles here, retirement calculators and free retirement planning resources available to download here.

If you’d like to speak to a financial advisor for tailored retirement advice please get in touch and schedule a no-obligation call.