An Independent Financial Advisor should be looking after your money for both the short and long-term. It’s a relationship that could span decades, so you want to be sure you’re making the right choice.

Firstly, get to know them. Ask yourself:

- Are they legitimate, registered and regulated?

- Do you like them?

- Do you like their approach?

- Are you being given all the information you need to make an informed decision?

- Do they come recommended?

Choosing a Financial advisor: Don’t base it on a gut feeling

When it comes to choosing a financial advisor, don’t base your decision, purely on a gut feeling or emotion alone. They might seem like a perfectly lovely person and you might like them, but that’s not the only thing that matters.

- Look at their costs – are they comparable and competitive to others?

- Ask to see their results – how do their investments perform against industry benchmarks?

- Are they tied to companies with poor practices?

It’s no good choosing an IFA because you like them, just to find out they have a poor track record in their investment decisions or that you’d be just as well with your money in a tracker fund.

Be sure to understand all of the costs involved with their advice including advice fees, platform charges, recommended products and any transaction costs.

Remember that Tied advisors can only ever be as good as the company they work for. Some of the biggest advice firms are STILL receiving industry scrutiny for shady pricing practices, hidden fees and hefty exit charges, years after the industry tried to get rid of them.

However much you like your advisor, you need to do your homework on the advice they’re offering.

How to Choose a Financial Advisor for retirement

Choosing a financial advisor for retirement is an important step in your financial planning process. Retirement planning is a specific area of financial advice that requires specific areas of expertise.

Since pensions are the primary vehicle for funding retirement, it will pay to deal with a pension specialist in retirement. They’ll be able to make sure that your money is invested in the most appropriate pension product and that you don’t end up paying over the odds in unnecessary fees for withdrawals etc.

The increased choice and flexibility for accessing your pension in the UK has brought with it added responsibility and risk. You need to work with someone who has:

- A deep understanding of pensions and how they work

- Experience of investing for income

- Long-term investment advice

- Later-life financial planning

You’ll also want to work with an advisor who can advise on estate planning, leaving a legacy and who can help make sure that you don’t run out of money in later life.

How to Choose a Financial Advisor: Questions to ask

You’re trusting a financial adviser to help you make important financial decisions, so there’s a few questions you should ask them before you decide whether or not to work with them.

Are you Authorised by the Financial Conduct Authority?

Only Financial Advisers that are regulated by the Financial Conduct Authority are authorised to give financial advice in the UK. The FCA is the body that protects consumers. Any investments made outside of an FCA regulated firm, will not be covered by the consumer protection that they offer.

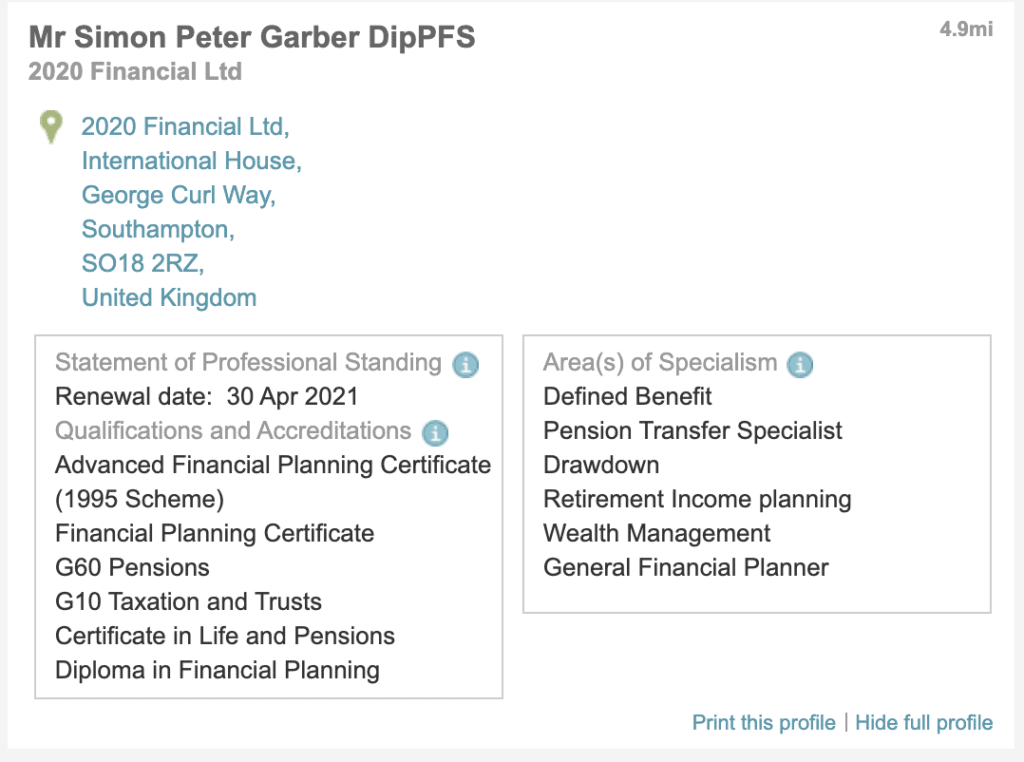

You should be able to find them on the Financial Service Register. Ask for the FCA register number (FNR Number) and also check what type of work they are authorised to do. Some work, like Defined Benefit Pension Transfer, can only be carried out by a Qualified Pension Transfer Specialist holding (G60) or (AF3) qualifications.

Our FNR number is 497332 and you can find us on the Financial Service Register here.

Are you tied or independent?

Tied advisers can only offer advice on a select number of investment products available through their employer or network. Independent Financial Advisers have access to the whole of the market. Independent Financial Advisers have more flexibility to find something that matches your needs more closely, and they may be able to offer you more competitive products.

You should be aware of whether the adviser is tied or independent. If they are tied, it is worth seeking a second opinion or quote from an independent financial adviser.

Is this investment regulated by the Financial Conduct Authority

Most of the horror stories you read about people losing their life savings are through bad investments in unregulated investments. These are the types of investments that offer a too-good-to-be-true promise of high returns with no risk, when, in reality, the opposite. is true – they are high risk and can result in your losing everything.

Unregulated investments are not protected by the FCA, so if anything goes wrong, there’s no chance for compensation.

Make sure that you’re not being seduced by the promise of high returns or putting your money at unecessary risk in unregulated investments. Ask the question, Do your homework and check with the Financial Conduct Authority if you’re unsure.

Do you have experience of carrying out this kind of work before?

They should be able to provide you with testimonials, reviews and or case studies of similar work they have carried out before. Ideally you want to work with someone who has an established process in place.

Where to Find a Financial Advsor

It’s important to find an advisor who is authorised and regulated to offer appropriate financial advice. Here are some places where you can find a financial advisor:

- The Financial Conduct Authority or FCA are the governing body for financial services in the UK. The FCA register lists authorised firms and individuals and the activities they have permissions for.

- The Personal Finance Society or PFS is the professional body for the financial planning profession in the UK. It lists around 22,000 qualified and accredited financial advisors on its Find an Advisor directory. You’ll be able to see each advisor’s qualifications and areas of specialism on their site too.

- The Money Advice Service (a free and impartial government-funded service) has a directory of authorised Financial Advisors, who must be registered with the FCA and offer personalised financial advice.

- Unbiased.co.uk is a directory for Financial Advisors, you can search and contact firms directly through their website. Unbiased require their advisors to provide their FCA registration number and perform checks but you should still carry out your own checks.

Avoiding Scams

The sad reality in today’s world is that Pension Scams are on the rise, and as a consumer you need to be aware of the risks.

Download our guide to protecting yourself from scams.

![Protecting yourself from pension scams [PDF]](https://www.2020financial.co.uk/app/uploads/2020/12/Protecting-yourself-from-pension-scams-PDF.png)

Talk to an Independent Financial Advisor

If you’d like to talk to an independent financial advisor, schedule a free, no-obligation call with one of our experts today. We’re FCA registered, PFS accredited and we hold the Pension Transfer Gold Standard.