Schedule a free discovery call with a Pension Transfer Specialist

If you have a lot of small pension pots or multiple pensions then Pension Consolidation could make it easier for you to track your money, control where and how you invest your pension and could reduce the fees you are paying.

But transferring your pensions could mean you lose valuable benefits you might not even know you have, so you have to make sure you get the right advice before you transfer anything.

If you're unsure get in touch today and our pension transfer specialists can help you decide what's right for you.

Arrange a Pension Transfer Specialist

No commitment, no hard sales, just a quick chat with one of our pension transfer specialist to see if we can help

Should I combine my pension pots?

If you’ve had more than one job in your lifetime, It’s possible that you’ll have built up multiple pensions. There’s no limit to the number of private pensions you can build up over your lifetime but you might find it difficult to keep track of them all if you’ve built up multiple pension pots. We are frequently asked by clients “should I put all my pensions together?” – here’s a quick overview:

Combining your pensions into one pot could:

- Make it easier to manage your finances and track your retirement goals

- Offer a greater choice of investment funds and access potentially higher returns

- Offer increased flexibility for accessing your pension

- Potentially lower your investment costs

If you have pensions with valuable guarantees, it might not be in your best interests to move it, even if it makes sense for the reasons listed above. Check out our blog post What to do with multiple pensions for more details of the pros and cons of combining your pensions.

What to do with multiple pension pots?

Over time you might accumulate multiple pension pots as you move from job to job.

The good news is that when you leave a job your pension stays invested in your old pension scheme unless you opt to move it, so you don't have to do anything.

The value of your old pension pot will be reliant on the investment performance of the pension fund your old employer has chosen and will be subject to fees as set out by the scheme.

If you've built up multiple pension pots. You’ve usually got 3 options for what to do with them:

- Leave it where they are

- Move your old pension pots to your current employer’s scheme

- Move your old pension pots to a Private Pension that you’re in charge of

In all cases it's important to understand the associated costs and implications of moving any pensions before you do so.

Whilst it might be easier to track and manage your money in a single pension pot, it's important to make sure that you won't be giving up valuable benefits by doing so.

If a pension has valuable benefits attached to it, then it's best to leave it where it is.

Important Note: If you have a Final Salary Pension the situation is very different. The amount you receive is guaranteed. It is not subject to investment fees or reliant on the performance of the fund (unless it fails, and you’ll be covered by the PPF). Read our Definitive Guide to Final Salary Pensions for more information.

What age should I consider consolidating?

There’s no right or wrong age for combining your pensions as long as it makes financial sense considering all the risks and benefits and you are doing it for the right reasons. It’s likely you’ll have different reasons in your 50s and 60s than someone who’s considering a transfer in their 30s or 40s.

If you are approaching retirement or want to flexibly access your pension from 55, then you might find it easier to combine your pensions.

Equally,if you want to purchase an annuity at retirement, you may be offered a better rate if you combine your pensions.

- And if you want to flexibly access your pension through pension drawdown, you’ll almost certainly find it easier to keep track of how much you have in your pension pot and what charges you are paying if it’s all in one place.

If you are paying excessively high fees that could be reduced by moving elsewhere then the earlier you move your pension, the better as the effect over time could erode the value of your pension pot.

The benefits of pension consolidation

As with most financial decisions, there can be pros and cons to combining your pensions. As long as you’re not giving up valuable benefits it can make a lot of sense to manage your pensions in one place, especially if you’re moving them to a Self Invested Personal Pension (SIPP).

Some of the benefits include:

Convenience

Greater investment choice and control

Flexibility to access drawdown

Potential to save on fees

Potential to access better-performing investment fund

Leaving an Inheritance*

*It’s worth noting that Defined Contribution Pensions and SIPPs can usually be passed on free of Inheritance tax to named beneficiaries. The fewer pension pots you have, the fewer pension scheme trustees you’ll need to keep updated of address changes, beneficiary changes and it will be easier to manage.

Find out more about the benefits of transferring multiple pensions.

Arrange a virtual coffee with an expert

No fees, no commitment, no hard sales, just a quick chat with one of our experts to see if we can help

Reasons why you shouldn’t transfer

As with most financial decisions, there can be pros and cons to combining your pensions. As long as you’re not giving up valuable benefits it can make a lot of sense to manage your pensions in one place, especially if you’re moving them to a Self Invested Personal Pension (SIPP).

Some of the benefits include:

Convenience

Greater investment choice and control

Flexibility to access drawdown

Potential to save on fees

Potential to access better-performing investment fund

Leaving an Inheritance*

*It’s worth noting that Defined Contribution Pensions and SIPPs can usually be passed on free of Inheritance tax to named beneficiaries. The fewer pension pots you have, the fewer pension scheme trustees you’ll need to keep updated of address changes, beneficiary changes and it will be easier to manage.

Find out more about the benefits of transferring multiple pensions.

Get Retirement Ready.

Discover everything you need to know about planning your retirement in our expert guide

The Impact of High Charges on Your Pension

Some older pension funds can have high investment charges compared to what is currently available on the market, so it may be possible to match the quality of the investments without the high price tag.

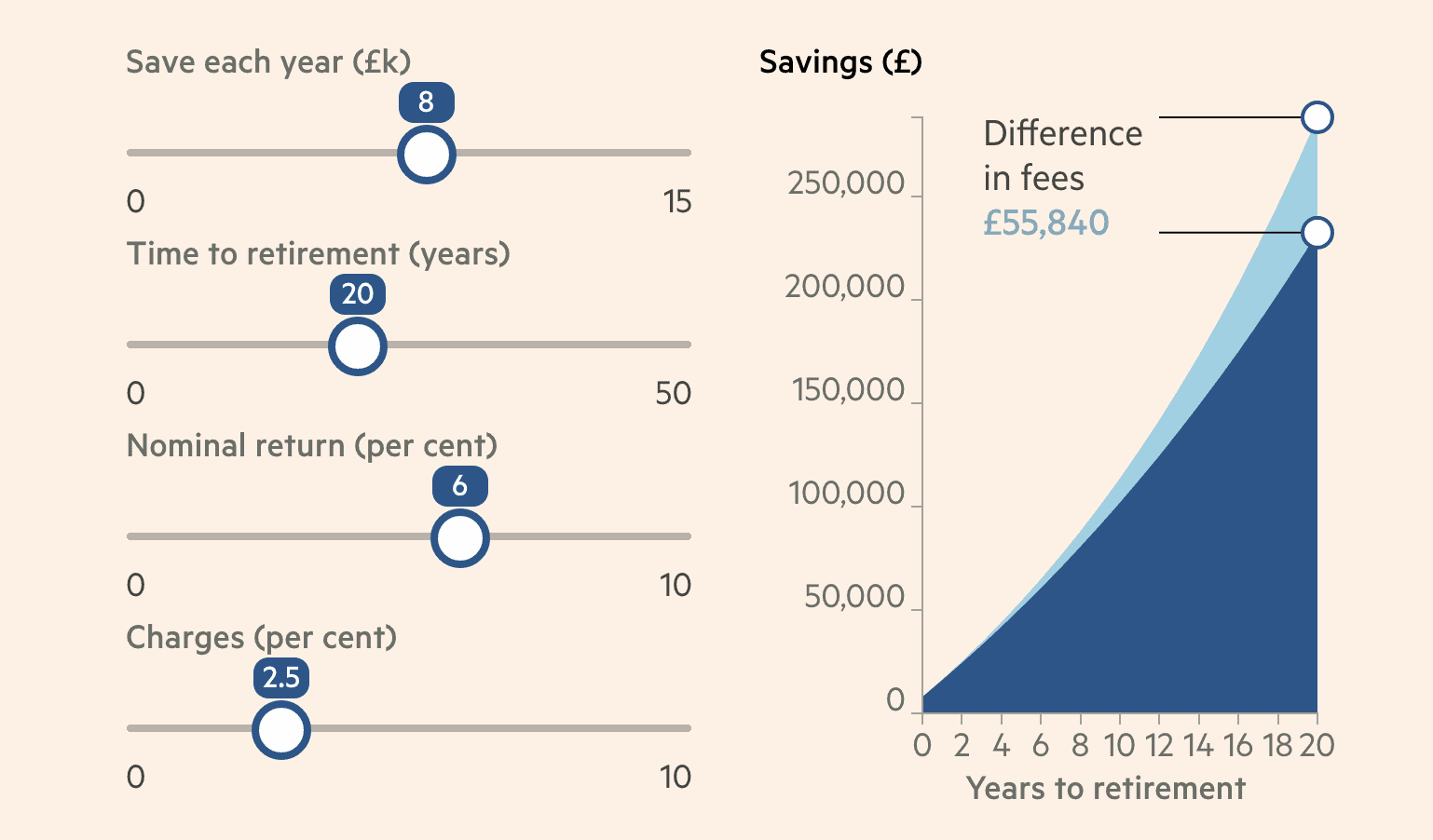

High investment charges can erode the value of your pension pot over time. For Example: If you invest £8,000 a year for your retirement 20 years away, and the fund’s total costs are 2.5% of the money invested, and the fund manager achieves an average return of 6% a year before fees, your savings pot will grow to £232,676

But, if the management fees were lower, at 0.8% , you would have made £288,516 — a £55,840 difference shown on the chart. If you continued to pay the higher annual charge, 19.4% of your savings would disappear in extra costs.

Consolidating your Pension for Flexi-access Drawdown

Flexi-access Drawdown was introduced with the Pension reforms of 2015. It removed the previous limits on how much you can take from your pension in any one year.

It’s now possible to access your Pension from 55 and you can take up to 25% of your pension as a tax-free lump sum, but you don’t have to take it in one go. If you want to take it in chunks or take an income from your pension, you can do that too.

Because Pension Drawdown is fairly new, some older pension funds aren’t set up for it, and you may need to move your money to a different pension that allows it.

As long as you’re not giving up valuable benefits, it may be easier for you to manage your money in retirement if it’s all in one place.

You might also be interested in trying our pension drawdown calculator (click here).

Multiple Pensions Tax-Free Lump Sum

Another benefit of the Pension Freedom changes is that you can now take 25% of your pension pot as a tax-free lump sum once you turn 55.

If you have multiple pension pots you are entitled to take a 25% tax-free lump sum from all of them or If you have £30,000 or less in all of your private pensions, you can usually take everything you have in your defined benefit pension or defined contribution pension as a ‘trivial commutation’ lump sum. If you take this option, the first 25% is tax–free, you’ll pay tax on the rest.

If you are a higher rate taxpayer, or if this money takes you into the higher rate tax bracket for the year, you could end up paying 40% tax on 75% of your pension pot.

Frequently Asked Questions

Don't miss

Our most popular posts

These are some of our most popular posts. Click below or head over to our blog to see other helpful articles on pensions, retirement and investing.

Got Questions?

Schedule a free, no obligation call with an IFA today and see how we can help you.