Schedule a free discovery call with a Pension Transfer Specialist

If you’re considering a final salary pension transfer, it’s important to get the basics covered first. So that you understand what it is that you’re dealing with.

We are qualified pension transfer specialists with over 17 years experience with Defined Benefit pensions and we also hold the Pension Transfer Gold Standard which holds us to a higher standard, ensuring you get the best advice available.

This guide is designed to give you basic, generic information, it shouldn't replace tailored financial advice If you'd like to talk about your pension get in touch today and our pension transfer specialists can help you decide what's right for you.

Arrange a Pension Transfer Specialist

No commitment, no hard sales, just a quick chat with one of our pension transfer specialist to see if we can help

What is a final salary pension?

Also known as a Defined Benefit Pension, these are the ‘gold-plated’ pensions you often hear about in the news.

A Defined Benefit Pension or Final Salary Pension guarantees its members a fixed retirement income for life (protected against inflation).

The amount you’ll get is normally calculated on your salary, how long you’ve worked for your employer and a calculation made under the rules of your pension scheme. This amount was often based on your salary at the end of your employment, hence the name ‘final salary’.

Final Salary pension schemes are generally far more generous than their Defined Contribution (Personal Pension) counterparts. In fact, they are often referred to as ‘gold-plated’ pension schemes for this very reason.

The Pension and benefits you will receive are pre-defined by your pension scheme administrators. Whilst each scheme is different in the full range of benefits it offers, members will receive:

- A guaranteed amount of Pension income for life

- Protection against inflation – the amount of money you receive goes up each year, normally in line with inflation. This protects the value of your pension over time.

Other benefits may include

- a protected retirement age,

- a survivor's pension for your Spouse/dependent children if you die (the amount varies by scheme)

- the option to take a cash lump sum on retirement.

Historically you could find Final Salary pension schemes in both the public and private sector, but they have been rapidly disappearing from the private sector with few remaining open to new members.

The rarity and value of these schemes should not be underestimated.

How is a final salary pension calculated?

Each scheme has its own rules that set out the basis of accrual and benefits, but most schemes provide benefits based on 4 key elements:

- The length of the pensionable service you were credited with as being an active member of the scheme i.e. how long you were working for your employer as an active member of your Final Salary pension scheme.

- Your pensionable salary

- The circumstances under which benefits are taken from the scheme (retirement, early payment, early leaver, ill-health, death etc.)

- The formula or rate of ‘accrual’ set by the scheme administrators, which uses service and salary to work out your pension.

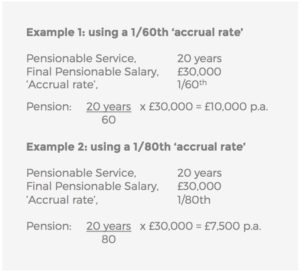

Accrual Rates: How do they work?

Your accrual rate will depend on the scheme you are in – could be 1/60, 1/80 or some less generous schemes could use 1/125. The example below shows how your accrual rate could affect how much money you get in retirement.

Working out your Cash Equivalent Transfer Value

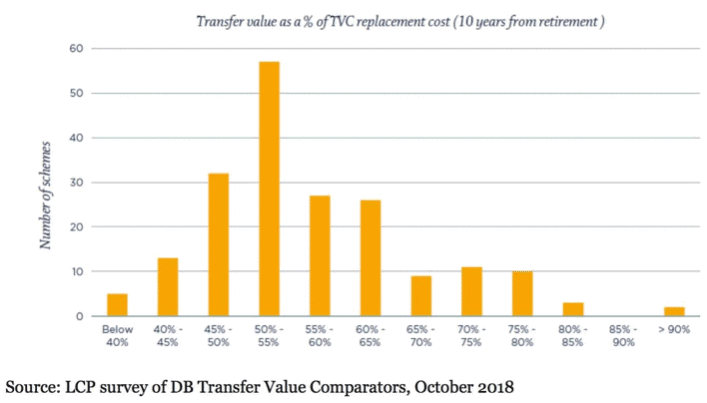

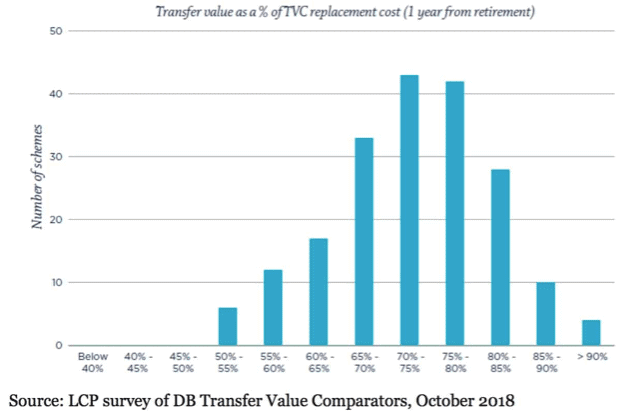

The amount being offered for Final Salary Pension Transfers varies hugely from scheme to scheme with some schemes offering as much as forty times your pensionable income.

Factors that can affect your CETV include

1) Your age at the time of transfer request

2) Your scheme retirement age

3) You pension scheme's funding position

4) The performance of the scheme’s investments

5) Cost of living and inflation rates

6) Life expectancy of the ‘average’ scheme member

It is worth remembering that Pension scheme administrators have the right to adjust pension transfer values to protect the remaining members of the scheme. If too many people are transferring out and it’s threatening the financial health or future of the scheme, they can reduce transfer values accordingly.

If you're trying to work out your Cash Equivalent Transfer Value, some pension schemes will automatically update your CETV on your annual pension statement, in other schemes you will need to request it.

We have developed a Transfer Value calculator that you can use to give you a rough guide of what you could be offered but it is always best to request an estimate from your pensions scheme administrator.

Try our CETV Calculator

Use our simple CETV calculator to see what your transfer value could be

Should I transfer my Final Salary Pension?

For the vast majority or people, the answer to this question is generally, no. Final Salary Pensions provide valuable benefits that will be lost if you transfer out. And these benefits usually cannot be replaced on a like-for-like basis. For most people a Defined Benefit pension transfer is not in their best interests.

That said, whether or not you should transfer is entirely dependent on your individual circumstances and goals. It’s not possible to give you an answer to this question without doing a full analysis of your situation.

As general guidance though there are factors that will make it more or less likely that a transfer would be suitable for you, which you can consider before you explore further.

Questions to ask yourself before you transfer your DB Pension

- Are you married or do you have dependent children?

- Do you have relevant investment experience?

- Are you comfortable with investment risk?

- Is your DB pension a supplementary income source that you could comfortably live without?

- Is your DB pension protected by the PPF?

- Can you achieve your stated goals staying within your existing DB scheme?

Find out why these questions matter below:

Other questions to ask include

1) Is there a genuine reason for moving my pension?

2) Will moving my pension allow me to achieve a goal that I couldn’t have achieved otherwise?

3) Would I be able to cope financially without the guaranteed income?

4) Do I understand the true value of the asset and benefits I am giving up, including the future value?

5) Am I comfortable knowing that the value of my pension could fall?

6) Do I have a spouse who would need a guaranteed income if I were to die early?

7) Am I confident I have access to the right investment and pension advice?

8) Do I have a plan to manage my money in a personal pension arrangement that protects the value of my pension and ensures I’ll have an income for life.

It’s important to take a holistic view of your situation before you consider cashing in your pension. It’s easy to let a high transfer value distract you from the difficult questions that need to be answered.

It’s always important to explore whether an alternative course of action could help you achieve your goals first, without you needing to give up your valuable guaranteed income and protected benefits.

Reasons you might want to transfer

Whilst Defined Benefit pensions are highly valued (and valuable) due to their guaranteed benefits, they are, by their nature, inflexible, especially when compared to the flexibility offered by Defined Contribution pensions.

There are 6 main reasons you might consider transferring your Final Salary Pension

A high transfer value

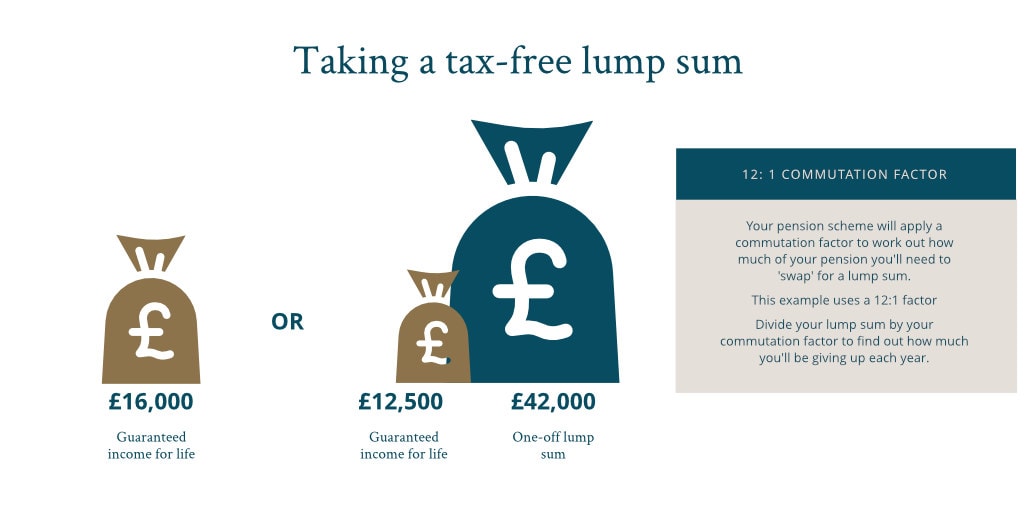

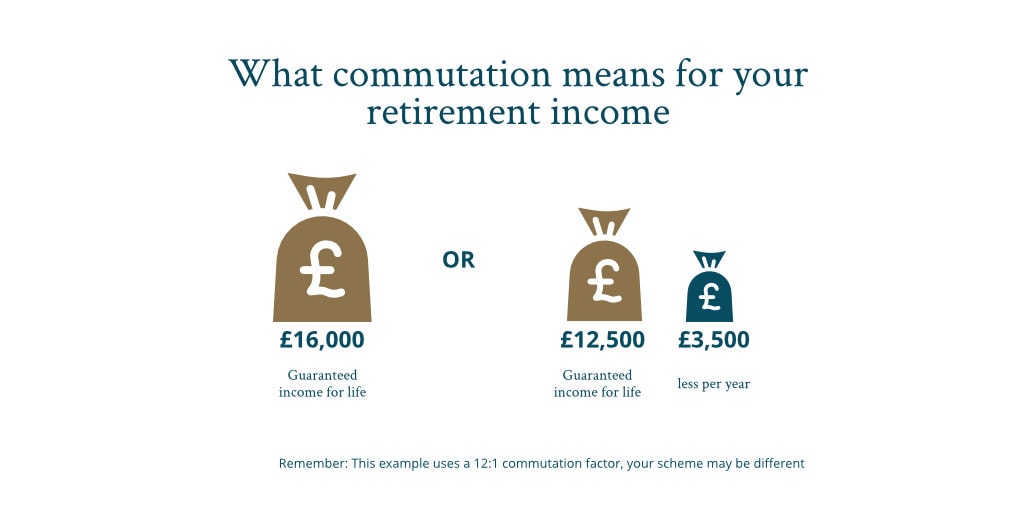

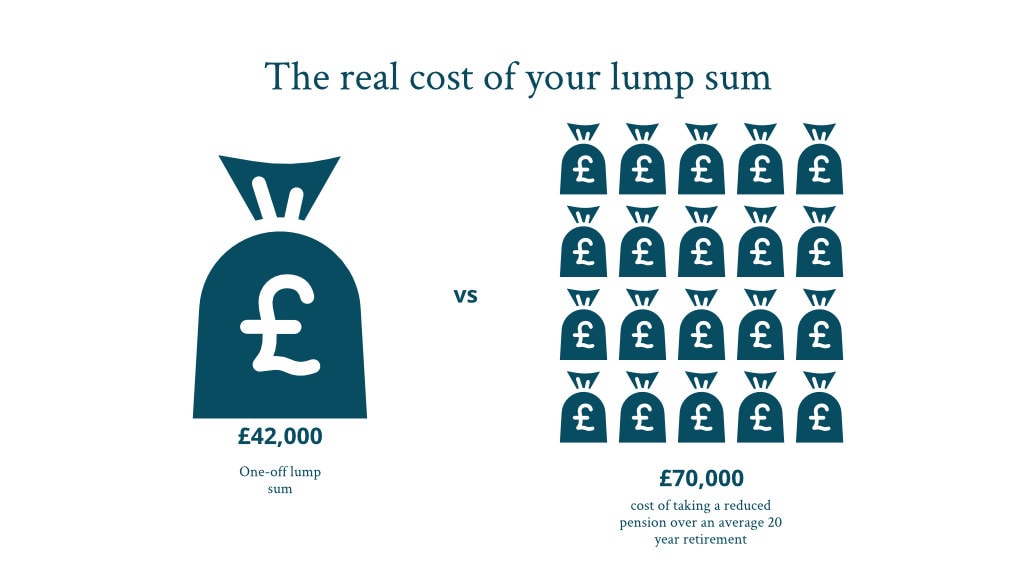

Potential to access a larger tax-free lump sum

Flexibility to access drawdown from 55

Early retirement

Passing on wealth when you die*

Ill health

Tax-planning

*It’s worth noting that Defined Contribution Pensions and SIPPs can usually be passed on free of Inheritance tax to named beneficiaries. find out what happens to Defined Benefit Pensions when you die

Final salary transfer benefits explained

Wondering Is it worth transferring a final salary pension? We've explained the main benefits below:

Arrange a virtual coffee with an expert

No fees, no commitment, no hard sales, just a quick chat with one of our experts to see if we can help

Final Salary pension transfer risks

The general advice for transferring your Final Salary Pension is – don’t, and for good reason.

Choosing to move a Final Salary Pension is an irrevocable decision, so even if the benefits of a Final Salary Pension Transfer appeal to you, you must also seriously consider the risks involved before making your decision:

The risks of pension transfer include:

Running out of money in retirement

Investment risk

Stress of managing your money

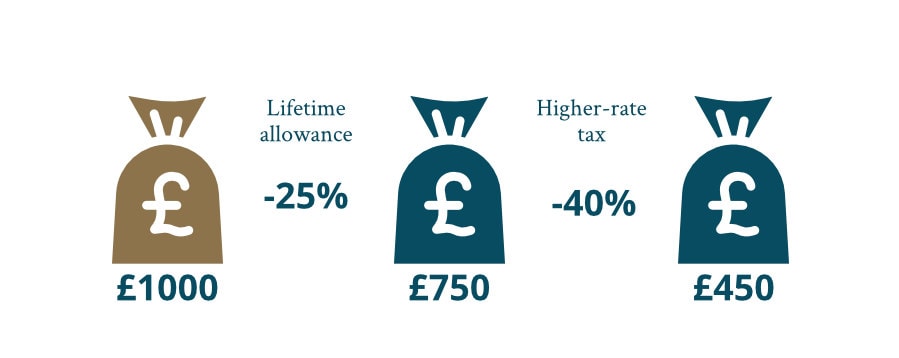

Triggering the Lifetime Allowance Tax

Loss of spouse's pension

Loss of inflation protection

Download our definitive guide to pension transfers

Discover everything you need to know about Defined Benefit Pension transfer in our expert guide

Is a pension transfer right for me?

When you transfer your Final Salary Pension you go from an investment that is guaranteed for life and protected against inflation to one that is subject to all of the risks of a standard investment. There are a number of factors that affect whether or not it might be suitable for you to transfer your final salary pension including (but not limited to):

- Your attitude to risk

- Your aptitude for risk (i.e. can you cope if your pension value goes down)

- Your age

- Your short & long-term goals

- Your investment experience

- The value of other assets/pension/wealth you hold

Can I take my final salary pension at 55?

The rules around whether you can take your Final Salary pension at 55 will be different for each scheme so you’ll need to check with your pension scheme provider first.

All final salary pension schemes have a fixed retirement age at which they will pay out but the specific age is different for each scheme. Some schemes have a protected early retirement age below 55, but most are around the 60-66 mark.

If your scheme retirement age isn’t set at 55 you’ll need to look into your options for early retirement.

Whilst some DB pension schemes allow members to take early retirement, it normally comes with stipulations:

1) Firstly, You’ll need to apply for early retirement

2) Your estimated pension income will be discounted for the fact you are retiring early

3) If you’re eligible for a cash lump sum, that will also be discounted.

Your scheme rules will depict how much your pension might be discounted by in order to reflect your early retirement. It’s important to take proper financial advice, because once you opt for early retirement, your income will be fixed at that level.

Unlike defined contribution pensions where you can access 25% of your cash as a tax-free lump sum from age 55. Final Salary pensions, normally only give you the option to take a tax-free lump sum at the same time as you take your pension.

Because of the way Final Salary Pensions work, you don’t have a specific pot of money to take 25% from, so your scheme administrators will calculate how much you’ll get based on their own workings.

What you are offered may not be equal to the 25% you might receive if your pension was in a defined contribution arrangement.

Early retirement is calculated differently for each pension scheme, so it’s important to contact your scheme administrator to find out what rules apply to you. More importantly, you should seek expert guidance to see if it’s in your best interests.

Specialist pension transfer advice

Our Independent pension transfer advice is designed to help you meet your goals in the best way for you, whether that’s exploring your options within your scheme or moving your pension to a defined contribution arrangement.

TRANSFER ANALYSIS

First we start with understanding you and where you want to be.

We’ll discuss your goals, talk about the risks and benefits of pension transfer and carry out a detailed fact-find and analysis to see if transferring is really in your best interests.

REPORT & RECOMMENDATIONS

You'll receive an in-depth report that assesses your suitability to transfer based on your goals, risk assessment and your personal and financial situation.

You'll receive suggestions for alternative courses of action & our expert recommendation.

MANAGE & REVIEW

If appropriate and if you decide to go ahead with transferring your pension, we will seamlessly manage your transfer to your recommended arrangement, offer regular portfolio rebalancing and provide ongoing advice & support to ensure you stay on track.

Frequently Asked Questions

Download our definitive guide to pension transfers

Discover everything you need to know about Defined Benefit Pension transfer in our expert guide

Don't miss

Our most popular posts

These are some of our most popular posts. Click below or head over to our blog to see other helpful articles on pensions, retirement and investing.

![Pension gold standard for pension transfers guide [PDF]](https://www.2020financial.co.uk/app/uploads/2020/12/Pension-gold-standard-for-pension-transfers-guide-PDF-300x300.png)