Knowing what looks like a good retirement income is one of those tricky retirement planning questions you’ll need to answer. If your retirement is a long way off it can be hard to imagine what that lifestyle will look like for you.

The latest Retirement Living Standards data from the PSLA (2023-24) estimates that a good retirement income is around £37,300 for a single person and £54,500 for a couple.

But ‘comfortable’ retirement income estimates vary wildly and carry a high level of subjectivity. These estimates are not a one-size-fits-all solution and shouldn’t be treated as such.

What is seen as a ‘good’ retirement income depends on your expectations for retirement. This will be influenced by your existing standard of living and your expectations and hopes for retirement. What experts do agree on, is that a good retirement income for you is based more on what currently feels like a good income level, than some arbitrary figure gathered from random data.

In general, most people’s expectations for retirement centre around a minimum expectation that their income level will allow them to:

- Avoiding deprivation

- Maintaining dignity

- Comfort

- Being a part of a community

- Happiness and wellbeing

All of these standards are subjective and relative to our own experiences. This means that what constitutes a good retirement income will differ for everybody.

How much pension do I need to retire comfortably?

The latest figures published by the Pensions and Lifetime Savings Association suggest that a couple now needs roughly £54,500 a year to enjoy a comfortable retirement, while a single retiree should aim for an annual budget of £37,300.

The PLSA definition of a comfortable retirement lifestyle is one that

- covers all your needs with some left over for fun

- gives you financial security and flexibility AND

- Affords you more financial freedom and some luxuries

The idea of comfort is relative and subjective. So working out what is a comfortable retirement income for you requires a more tailored approach. At its very minimum, you should be able to maintain your current standard of living. That’s enough to cover the basics, some comforts and your chosen luxuries.

Comfort Definition

the state of having a pleasant life with enough money for everything that you need

Cambridge Dictionary

Target Replacement Rate for retirement income

Target Replacement Rate was created by the Pensions commission as a way of estimating how much individuals will need in retirement to maintain their pre-retirement living standard.

It takes into account that whilst some of your day-to-day spending might stay the same, you’ll be spending less on mortgage payments, commuting costs, supporting dependent children etc once you’re retired.

As a general rule of thumb, you’ll need between half and two-thirds of your pre-retirement income in retirement. For high earners, it assumes that in retirement you’ll need 50% of your pre-retirement earnings

| OVERALL 2004 INCOME BAND | INCOME BAND IN 2021 EARNINGS TERMS | TARGET REPLACEMENT RATE |

| Up to £9,500 | Up to £15,000 | 80% |

| £9,500 – £17,500 | £15,000 – £27,500 | 70% |

| £17,500 – £25,000 | £27,500 – £39,300 | 67% |

| £25,000 – £40,000 | £39,300 – £62,800 | 60% |

| Over £40,000 | Over £62,800 | 50% |

For example, take someone in the UK living on the Median wage pre-retirement of £33,280 (the UK average income 2023). The target replacement rate states they would need 67% of their pre-retirement income to continue living the same way when they retire, which puts a good retirement income at £22,297.60.

In comparison, anyone earning over £62,800 would only need 50% of their pre-retirement income, £31,400 to maintain a comfortable standard of living in retirement. Note that this is below the comfortable retirement figure of £37,300 set out by the Retirement Living Standards.

Minimum income standards in retirement

Research from The Joseph Rowntree Foundation looks at what working-age adults and pensioners say is needed for an acceptable standard of living.

The Minimum Income Standard (MIS) is based on what people think UK households need in order to meet material needs such as food, clothing and shelter. It also considers the opportunities and choices required to participate in society. The figures are updated every few years to reflect current lifestyle standards and inflation.

| Minimum income Standard 2023 | |

| Single retired person | £16,996 |

| Retired Couple | £26,113 |

If you’re looking for a ‘good’ retirement income, you’ll want to make sure you’re meeting at least the minimum standard.

What is the average UK retirement income?

The average retired household income in the UK is £26,780 (Office for National Statistics, 2023). This figure is well below the £34,000 the PLSA says a couple needs to enjoy a moderate-income standard and is less than half the £54,500 a couple needs for a comfortable retirement.

Research by Which? Showed that spending levels vary greatly between pensioners. On average, they found that couples would spend £28,000 a year, whilst those who were looking to enjoy long haul holidays and a new car every five years were more likely to spend around £44,000.

Our experience with wealthier clients has shown us that some of these average estimates for a comfortable retirement income would be wildly insufficient. In some cases, this ‘comfortable’ retirement income would barely cover our wealthier clients’ travel budget or gifts to children.

Spending in retirement is not a one size fits all affair. It varies wildly.

What is a wealthy retirement income

We asked our retirement specialist Simon Garber what a wealthy retirement income looks like…

“Our wealthiest clients tend to be couples who are generally sitting on combined pension pots of between £3-£4 million pounds at 55 (independent of savings and property wealth).

These couples expect to have a retirement income of between £5,000-£8,000 a month or between £60,000 and £96,000 a year (after tax).

Whilst retirement estimates from Which budget around £4.6k a year for travel in their ‘luxury’ retirement bracket, we have clients whose annual travel budget is over 9 times that amount at £45,000… and we’re not dealing with the wealthy elite, our clients are engineers, air traffic controllers, retired headmasters and company directors.

Many of our wealthy clients are considering purchasing a property abroad, usually in the £200-£400k bracket or a motor home.

We also have clients who budget at least £500 a month (£6,000 a year) in private school fees for grandchildren as well as making regular gifts of up to £10,000 each to adult children.

These clients are not atypical. Many people we speak to, even the ones who wouldn’t consider themselves wealthy are planning on making large gifts to children or grandchildren.

What’s interesting is that these ‘wealthy’ individuals are not buying ferraris and yachts, in fact, their day to spending tends to be fairly restrained. They’re not living off of champagne and caviar.

Many of these couples are replacing their pre retirement income net of mortgage payment, university support or school fees, their day to day spending is not changing.

Of course wealth is relative. Even an £8,000 monthly income might feel extremely frugal to someone who’s used to earning 10 times that.”

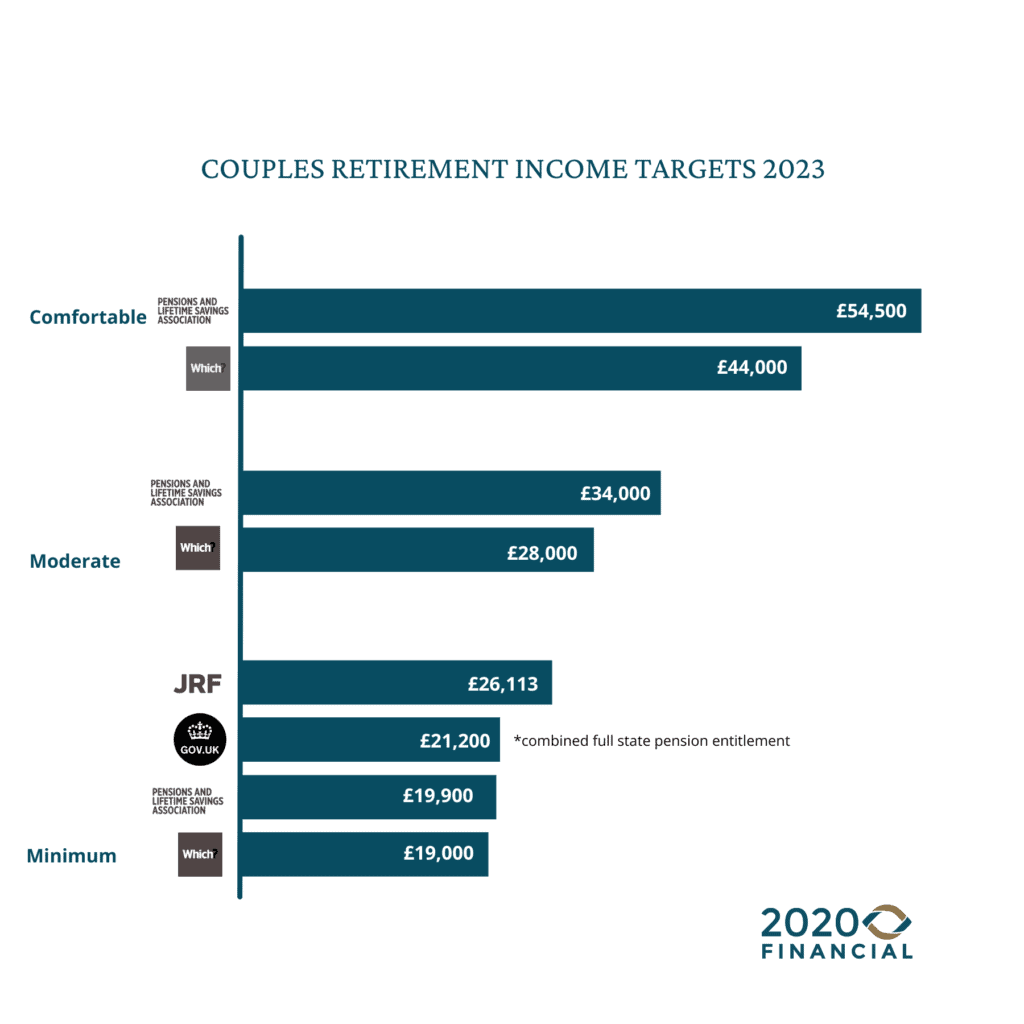

Good retirement income for a couple

Estimates for what constitutes a good retirement income for a couple (described as moderate to comfortable Retirement Living Standards) vary between £28,000 and £54,500.

The PLSA estimate a moderate retirement income for a couple at £34,000 a year, whilst recommending £54,500 for a comfortable retirement.

Highly publicised retirement income targets by consumer group Which recommend £28,000 for a comfortable retirement and £44,000 a year for a luxury retirement.

These estimates are probably fairly accurate for individuals earning close to the UK average income, but for higher earners, they are likely to be insufficient.

Couples who have enjoyed a pre-retirement income above £100,000 should use Target Replacement Rate and aim for no less than 50% of their pre-retirement income in retirement.

If you both qualify for the full state pension of £10,600 (2023-24), you’ll still need to find at least £17,400 a year from private pension savings or other sources to cover the most modest estimate for a good retirement income and an extra £22,800 to enjoy what the PLSA refers to as comfortable, but Which would describe as luxury.

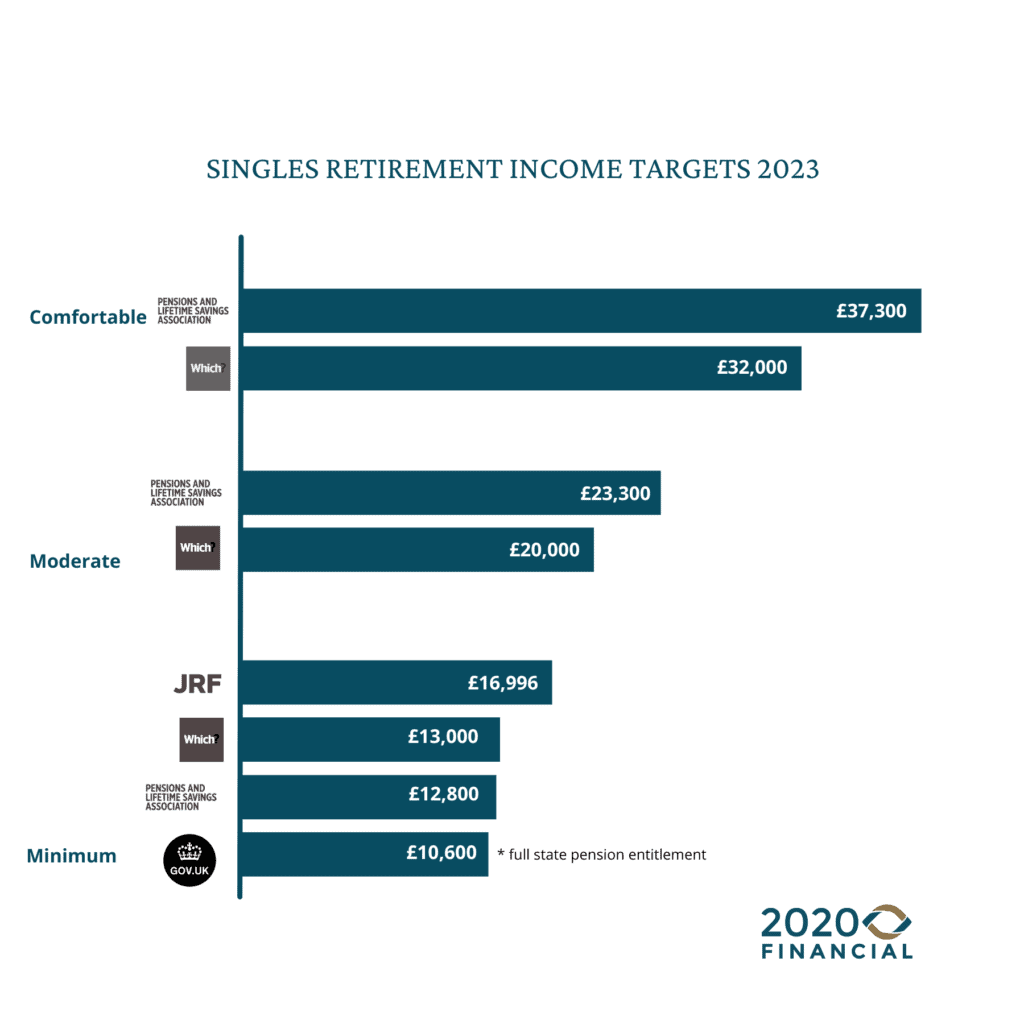

Good retirement income for a single person

Estimates for what constitutes a good retirement income for a single person vary between £12,800- £37,300

The PLSA estimate a moderate retirement income for a single person at £23,300 a year, whilst recommending £37,300 for a comfortable retirement.

Consumer group Which recommendations for a single person range between £20,000 for a comfortable retirement and £32,000 a year for a luxury retirement.

Using target replacement rate, a single person used to earning £100,000 a year will need £50,000 a year in retirement to maintain their existing standard of living.

As a single person, if you qualify for thefull state pension of £10,600 (2023-24), you’ll still need to find at least £12,700 a year from private pension savings or other sources to cover the most modest estimate for a good retirement income or an extra £26,700 to enjoy what the PLSA refers to as comfortable, but Which would describe as luxury.

A high earner on £100,000 a year would need to supplement the full state pension by almost £40,000 a year in retirement to feel like they’re on a good retirement income.

Understanding Retirement Income Targets

Retirement income targets as set out by the PLSA are relatively new to the UK. They seek to simplify retirement planning by using agreed standards that will suit ‘most’ people.

Based on the Australian system, they outline 3 distinct retirement lifestyle options contrasting a minimum, modest and comfortable retirement standard.

They are designed to show you how much your desired lifestyle will cost you in retirement and help you plan accordingly.

The retirement budget is based on a wide range basket of goods and services and includes spending on

- House

- Food & drink

- Transport

- Holidays & Leisure

- Clothing & personal

- Gifts & helping others

The current retirement targets set out by the PLSA include figures for single people and couples living in the UK with adjustments for those living in London

| Single | Couple | |

| MINIMUM Covers all your needs, with some left over for fun | £12,800 London £14,300 | £19,900 London £21,100 |

| MODERATE More financial security and flexibility | £23,300 London £28,300 | £34,000 London £41,400 |

| COMFORTABLE More financial freedom and some luxuries | £37,300 London £40,900 | £54,500 London £56,500 |

What’s a good pension pot size

According to the PLSA, moderate and comfortable retirement targets require private pension pots of between £440,000 – £1,100,000 for a single person household (outside of London). For couples, this figure is between £480,000 – £1,475,000. As you can see, the amount a single person needs is not much less than for a couple.

This is down to:

• The two-person household receives twice the State Pension income

• The targets for a two-person household are only about one and half times that for a single-person household.

If you’re not planning to follow the PSLA pension targets there is another way to estimate what a good pension pot size looks like.

As a general rule of thumb, for every £3,000-£4,000 of retirement income, you’ll need around £100,000 in your pension pot. Anyone wanting an annual retirement income of £50,000 would need a pension pot of between £1.25-£1.67 million.

N.B. Don’t forget that pension income is taxable.

Pension contributions for a good retirement

Typically, most people will need to increase their pension contributions to maintain a minimum standard of living in retirement. However, your pension contributions depend on many things:

For example, how much do you have in your pensions pot? When do you want to retire? How much can you afford to save regularly? Do you qualify for the full state pension?

This is something that a financial advisor can help you figure out and adapt accordingly.

While current auto-enrolment levels are around 8%, experts agree that most people need to save closer to 15%-20% of their income for retirement.

Planning your retirement

Planning for your retirement is an incredibly personal and unique process; although there are certain steps that are worth following.

Here at 2020 Financial, we break those steps down into:

- Setting a retirement goal

- Assessing your current financial standing

- Deciding how much money you’ll need in retirement

- Starting to save enough to provide that type of retirement

Find out more by reading our in-depth ‘How to start planning for retirement’ blog.

Still looking for more support? Download our Comfortable Retirement Guide or get in touch to speak to an independent financial advisor.