Schedule a free discovery call with an independent financial advisor

RETIREMENT PLANNING ADVICE IN Lyndhurst

There’s never been a better time to plan, save and invest.

Looking for a Lyndhurst retirement advice specialist near you that can help with your retirement plans?

Our retirement planning specialists can help you make the most of your retirement fund.

Now is the right time to take back control of your future wealth

If you’d like to understand your options at retirement and maximise your money contact us for a free, no-obligation chat.

Future-you needs this

Lyndhurst is one of the best places in the UK to retire. Known for its picturesque surroundings in the centre of the New Forest, with an array of shops, pubs and cafes it offers so much to retirees.

But a comfortable retirement doesn’t come cheap here, so you’ll need a solid retirement plan to make sure you can enjoy the kind of retirement you deserve.

A happy retirement is a financially secure one; it’s as simple as that. By putting the plans into place now - and slowly but surely building your investments - you can sleep easy in the knowledge that everything you’ve ever wanted is waiting for you.

Retirement Planning Advice available for Lyndhurst Clients

From our base we offer face-to-face retirement planning advice for people across the South Coast and in Lyndhurst and Hampshire.

We think you'll love our tailored service

We provide bespoke retirement planning and a range of wealth management services for clients in Lyndhurst. These include:

PENSION ADVICE

We deliver the very best tailored, specialist advice on all types of pension and are one of the few qualified pension transfer specialists in the industry. We can advise you on everything from defining and reaching your financial goals, the intricate details of taking tax free cash and how to efficiently (and impactfully) plan your pension drawdown.

RETIREMENT PLANNING

We’re here to help you build a retirement plan designed to make sure you get to experience the kind of retirement you've always dreamed of. We are experts when it comes to creating robust, risk-sensitive plans, and will also provide early retirement advice, legacy-planning guidance and steps for tax-efficient saving.

INVESTMENT ADVICE

Come to us for independent advice focused on your unique circumstances, needs and goals for the future. You will also gain access to our exclusive hybrid investment model offering you unparalleled access to the best investment brains in the world.

DEFINED BENEFIT PENSION TRANSFER

We are qualified pension transfer specialists who can offer specialist advice and analysis if you’re considering transferring your defined benefit pension. You’ll also find a range of free resources we’ve created to help you understand the risks and benefits involved.

Arrange a virtual coffee with an expert

No fees, no commitment, no hard sales, just a quick chat with one of our experts to see if we can help

Getting Retirement Ready

So, you’re ready to think about your retirement. Excellent - that’s music to our ears! The great news is that you don’t have to tackle this road on your own. We’re here to help you build a retirement plan based on your current lifestyle and commitments and your dreams for the future.

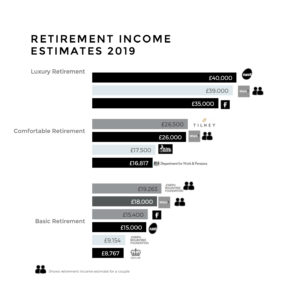

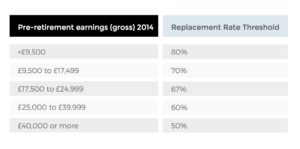

HOW MUCH DO YOU NEED TO RETIRE?

This is one of the most common questions our customers ask; the truth is, there is no clean cut answer! We’ll work with you to identify how much you personally need to invest in order to have a retirement that fulfils all your aspirations, based on your appetite for risk and capacity for investment.

BUILD FOR YOUR FUTURE

Haven’t reviewed your pension in a while? It’s time you did! We’ll identify how much you will need throughout your retirement, how much you need to save every month, ways to boost your retirement fund and any tax-efficient pension and savings plans that could maximise your money.

TRACK YOUR PROGRESS

It’s important to know where you’re at in your retirement saving journey; you can check in on this 24-7 with our exclusive digital investment platform. Wherever you are in the world, your financial planning will be right at your fingertips.

Learn more about our award winning platform

PENSION CONSOLIDATION

It’s common to have countless pension pots floating around - but chances are, you’d rather have all of your investments in one place. We can review your current fees, benefits and fund performance and if appropriate help you consolidate your pensions.

RETIREMENT PLANNING GUIDE

Get Retirement Ready

Discover everything you need to know about planning your retirement with our expert guide

Retirement Planning Calculator

We offer a range of free retirement planning calculators and tools designed help you with your retirement planning. Choose from the list below or visit our retirement calculators page to see all of our available calculators.

So, you’re ready to talk to a retirement planning specialist? Here’s how we can support you.

Get the right information

Explore our gallery of free guides - because informed is empowered.

Visit our retirement blog

Read our expert advice on how to get more from your pension.

Schedule a free call with us

Speak to an IFA. No fees. No obligations. Let’s just see if we can help.

The importance of retirement planning

It’s been suggested that two-thirds of couples aged over 40 don’t know how much they will have at retirement, with almost a quarter never having the discussion in the first place. And with over a fifth of UK adults believing they’ll never be able to afford to retire it’s more important than ever to start planning your retirement.

With some simple financial planning measures, the retirement your dreams of could be within reach, so don’t put it off. Do something today that future-you will thank you for.

We’ve been serving clients on the south coast for over a decade.

This is what they have to say.

LUCY BRAMLEY, 2020 FINANCIAL CLIENT

"...I really like the fact that they are always looking out for ways their clients can prosper"

I’ve been with 2020 Financial for over 10 years. Over this time 2020 Financial have helped me to invest wisely and save money on my pension and savings products.

I really like the fact that they are always looking out for ways their clients can prosper. I find 2020 Financial extremely easy to do business with and would not hesitate to recommend them to my friends and family. Great job!

Just a few of the reasons Lyndhurst clients choose 2020 Financial.

NOT YOUR AVERAGE FINANCIAL ADVISOR

- 100% tailored 1-2-1 financial advice from a retirement planning and pension specialist

- 24-7 access to our intuitive, multi-layered investment platform

- An investment strategy that recognises your current life and future commitments, all geared towards helping you achieve financial freedom

- Support from the world’s most innovative investment minds

- A non-judgemental, collaborative Independent Financial Advisor who works purely within your best interests

- Totally transparent pricing and absolutely no hidden costs… ever

Frequently Asked Questions

Retirement planning doesn't have to be complicated, with the right plan in place, and the right support, your dream retirement can feel like a breeze.

We've laid out some simple steps in retirement planning below, but if you get stuck, just reach out and one of our retirement planning specialists will be happy to help you:

- Decide what type of retirement you want to enjoy

- Set a retirement date

- Work out a retirement budget based on what feels like a good retirement income for you.

- Request a pension forecast - request your state pension forecast here https://www.gov.uk/check-state-pension

- Get your pension estimates - track down old pensions with the Pension Tracing Service (0800 731 0193)

- Talk to a Financial Advisor to create a retirement plan, work out how you will pay down any debt and if it's worth consolidating any old pensions

- Put your retirement plan in action and look forward to enjoying your retirement.

- Don't forget to periodically review your plans every year to make sure you're on track, because circumstances can change and the earlier you respond the more time you have to course correct.

Ready to get started?

That’s music to our ears! We cannot wait to get to know you and find out where you are on your retirement journey. Together, we can lay down the building blocks to set you up for a prosperous future.