Schedule a free discovery call with a Independent Financial Advisor

You’ve put so much hard work into saving for your retirement; but how much will your pension be worth when you hit retirement age?

Our pension forecast calculator can help. It will:

- use your contribution amount and time frame alongside your investment types to deliver a rough idea of how much your pension will be worth at retirement

- show you how different variables will impact the overall value of your pension pot

- deliver realistic figures based on over 100 years of UK market research

How our pension forecast calculator works

Our pension forecast calculator isn’t just simple to use; it’s realistic. It’s been created using UK data from over 100 years, taking into account the highs and lows of different market conditions.

All you have to do is tell us how much you’re saving and for how long. We’ll then show you how much your pension pot could be worth when you retire.

Sound good? Then let’s begin.

User Guide for our Pension Forecast Calculator

Want to know what figures to enter into the calculator? See our user notes below

You can use the calculator to test out different scenarios.

How much you pay in

You can adjust the settings and see how much it would impact the value of your pension pot, including if you paid more or less into your pension every month. This will help you with your overall retirement planning.

Your investment term

Consider what would happen if you paid in for longer or shorter periods by amending the investment term section on the calculator (and what impact this would have on your day-to-day life).

How you invest your pension

The calculator also allows you to explore the repercussions of different investment strategies on your pension worth, including those with a higher capacity for risk.

Arrange a virtual coffee with a pension specialist

No fees and no commitments; just a free, confidential conversation about your financial future.

How to use our Pension Forecast Calculator

This pension forecast calculator estimates potential pension growth over time to forecast the value of your pension pot at retirement. It will take into account not only your pension contributions but also estimated investment growth and compounding returns.

You can adjust the following variables:

- monthly/annual pension contributions

- the value of your existing pension/s

- how long you’ll be saving for

investment portfolio

You can also use our calculator to see how different investment strategies will affect the final value of your pension pot at retirement.

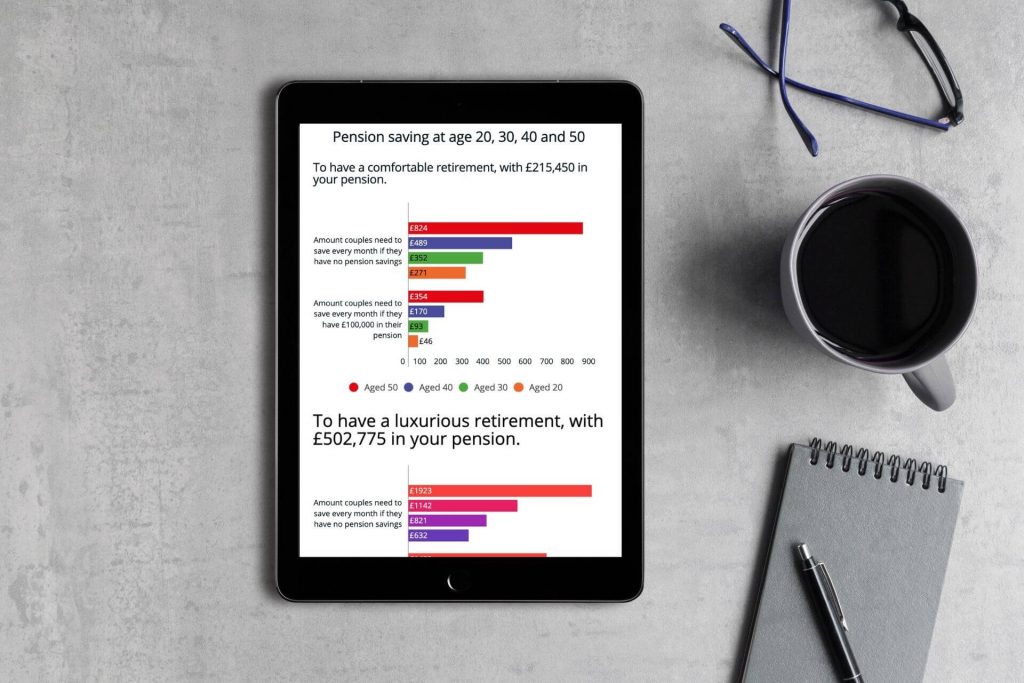

If you know how much money you need in retirement, you can see if your current rate of savings, coupled with your investment strategy/ risk profile, will enable you to reach your retirement goal.

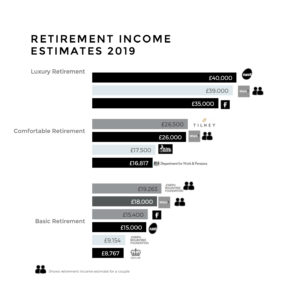

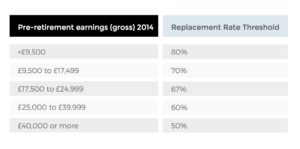

Use our retirement cost calculator to determine how much you need to retire.

Read more in our handy guide: how much you need to retire.

You can adjust your contribution term to see how this might affect your pension pot value at retirement, i.e. how saving for a longer or shorter period might impact how much money you have in retirement.

How Much Will my Pension be Worth?

The value of your pension at retirement will largely depend on

- how much you pay in

- investment term (how long you’re paying in for)

- how you choose to invest your money

This calculator allows you to adjust all of these factors so that you can see how much your pension will be worth using different scenarios i.e.

- paying more or less into your pension every month,

- paying in for longer or shorter periods

- choosing different investment strategies

How you choose to invest your money should be in line with your tolerance for risk. You shouldn’t be encouraged to take more risk than you are comfortable with to try and reach your retirement goal faster or to try and make up for lower pension contributions.

Frequently Asked Questions

This pension forecast calculator is provided for general information purposes only. It is a guide and does not reflect the actual amount that you will need in retirement.

Any information contained within this website should not be deemed to constitute financial advice, and should not be relied upon as the basis for a decision to enter into a transaction, or as the basis for any financial or investment decision. It is provided for general information and it is vital (and in most cases a regulatory requirement) that you contact a Financial Adviser for tailored professional advice in regard to pension and retirement planning.

- No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.

- If you are a member of a pension scheme with safeguarded benefits, it is likely it would be in your best interests to retain the safeguarded benefits.

- Make sure you understand all the risks before investing.

- The value of investments and the income they produce can fall as well as rise and you may not get back your original investment. Past performance is not a reliable indicator of future results.

Download our free expert guide to

Planning for your Retirement

Discover everything you need to know about retirement planning including your pension and income options and how to avoid pension scams

For even more inspiration, check out our blog

Our most popular posts

These are some of our most popular posts. Click below or head over to our blog to see other helpful articles on pensions, retirement and investing.