Schedule a free discovery call with a Pension Transfer Specialist

Our Singles retirement cost calculator has been updated for 2023/24 to include the lastest UK State Pension figures and minimum income standards and costs for retirement.

We've created this calculator as a generic tool to help give you a 'ballpark' figure to start planning your retirement. Whilst this calculator has been created with the help of retirement experts, it is absolutely not a susbsitute for personalised expert advice and shouldn't be seen as such.

What it does include is up-to-date pre-populated costs for popular activities and purchases based on UK average costs in August 2023, which will help you:

- understand the rough numbers around your retirement based on your expenditure

- use our simple calculations to help you budget accordingly

- gain the confidence to make the right decisions for your future

- have the opportunity to receive further, in-depth and tailored advice from our team of investment specialists

How our singles retirement cost calculator works

You want to enjoy the retirement of your dreams; we want to help you get there.

We’ve taken the hard work out of retirement planning with our free calculator. It’s based on up-to-date industry figures and average retirement spending for single people - alongside our own research - to deliver straightforward calculations that will help you budget for your golden years.

Simply run through each step and tell us your financial and lifestyle commitments. We’ll cover the rest.

Why should you use this retirement calculator?

Control your financial future

64% of UK employees aged 45 and over do not know how much money they need to save for a comfortable retirement. We believe it's time to change that. This calculator will put the control back in your hands, kickstarting the process in an easy, empowering way.

Get excited about retirement

Our retirement calculator allows you to handpick all the activities you want to enjoy in retirement… It's designed to be a fun tool to help you gain an exciting picture of what your retirement could look like. Because we believe your retirement should be a cause for celebration.

Put a Plan B in place

Our calculator will help you understand how much you’ll need in retirement so that you can start planning. If you’re worried that you won’t have enough time to hit your goals, it gives you the prompt and opportunity to speak to a financial adviser and put a new plan in place.

Arrange a virtual coffee with a specialist

No hard sales. No obligations. Just an open, honest chat with a retirement specialist to help you understand your current position and hopes for the future.

How much does a single person need to retire?

As a single person, whilst some of your retirement costs might be less than a couples, some of the larger costs that you might encounter in retirement, like living costs and transport and travel can't be shared, so you'll need to budget accordingly.

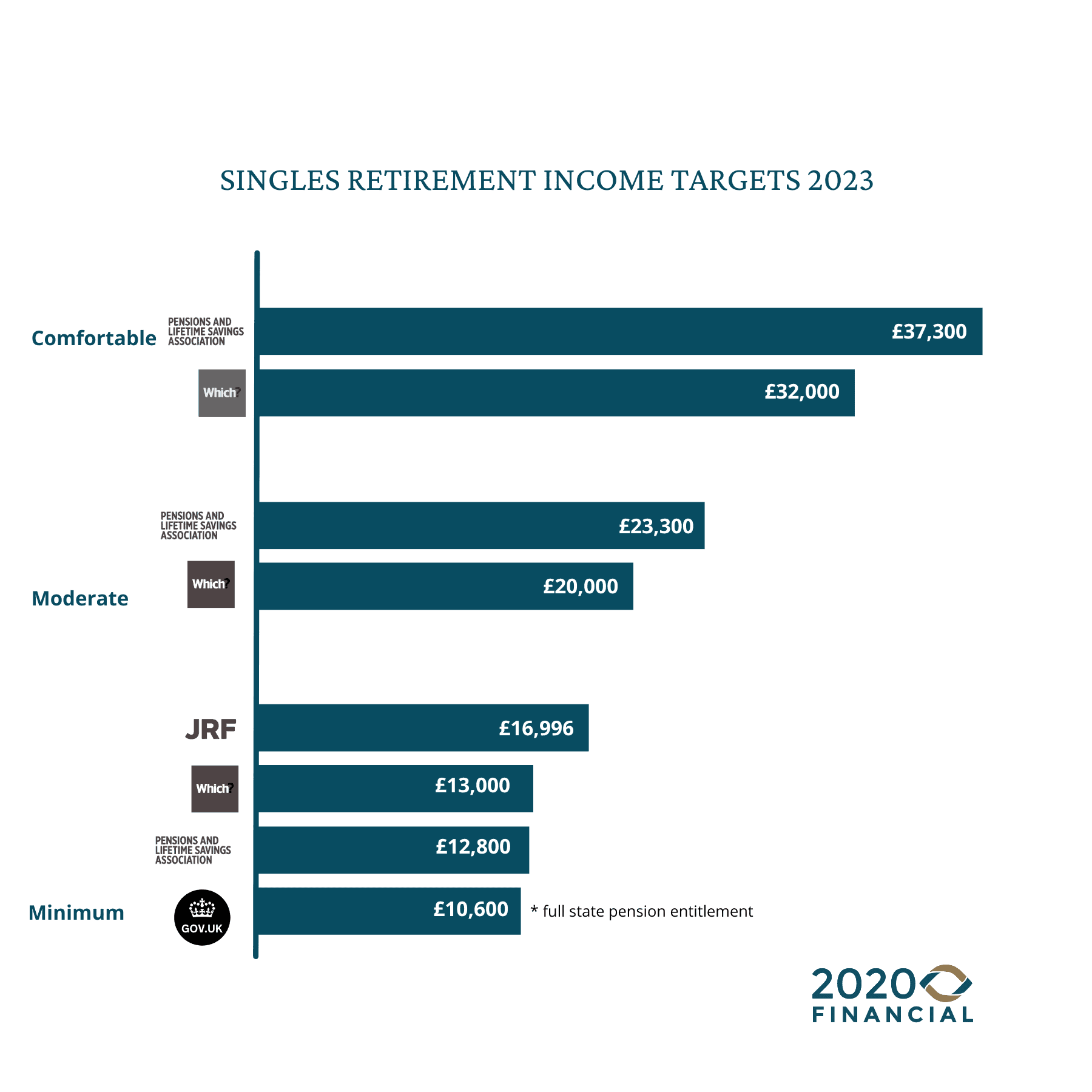

The minimum recommended amount of income for a single person in retirement in 2023 is £16,996 per year. But that really only covers the basics. PSLA estimates put the figure between £23,300 and £37,300, depending on your desired living standard.

Of course none of these estimates reflect what you need individually. As a rule of thumb as a single person, you'll need around two-thirds of your pre-retirement income to sustain the same standard of living in retirement.

Of course, the best way to work out how much you need to retire is to start with a calculator like the one above and build a retirement plan that's tailored to you.

Average UK Retirement Income

The average retired household income in the UK is £26,780 (Office for National Statistics, 2023) although there are no official figures available for single households in retirement.

Research by the Pensions and Lifetime Savings Association shows that, as a single person, you'll need £23,300 a year to enjoy a moderate retirement and £37,300 for a luxury retirement standard. It's easy to see from the UK average retirement income, that most people are nowhere near achieving a luxury retirement income.

But let's look at spending, as anyone who's ever found themselves in their overdraft or facing a hefty credit card bill will attest, income doesn't necesarily reflect how much you're spending. In fact, the latest research by Which? Showed that spending levels vary greatly between pensioners.

On average, the research shows that single people living a basic standard of living are spending around £13,000 a year, those with a moderate or comfortable living standard are spending £20,000 a year (almost double the full State pension amount) and the lucky ones enjoying a luxury retirement are spending around £37,300 a year.

How much should a single person save for retirement?

When it comes to saving for your retirement, it’s best to overestimate how much you’ll need when it comes to money, it’s always better to have more rather than less than you need. As you may not have the earning ability in later years to top up your income.

How much you need to save for retirement as a single person depends on:

- How much you've already saved for retirement

- Your desired income in retirement

- What age you want to retire

- What other assets you have to fund or partly fund your retirement

- Whether you're eligible for the full state pension

If you're not sure how much you need to save for retirement. A financial advisor can help you build a solid plan to reach your retirement goal.

How we worked out the retirement costs for a single person

This calculator is designed to be used a general guide, it can be a useful tool for retirement planning but it’s not designed to replace professional, tailored advice. We used part research, part average figures to work out these costs details of which can be found here:

Frequently Asked Questions

Retirement planning doesn't have to be complicated, with the right plan in place, and the right support, your dream retirement can feel like a breeze.

We've laid out some simple steps in retirement planning below, but if you get stuck, just reach out and one of our retirement planning specialists will be happy to help you:

- Decide what type of retirement you want to enjoy

- Set a retirement date

- Work out a retirement budget based on what feels like a good retirement income for you.

- Request a pension forecast - request your state pension forecast here https://www.gov.uk/check-state-pension

- Get your pension estimates - track down old pensions with the Pension Tracing Service (0800 731 0193)

- Talk to a Financial Advisor to create a retirement plan, work out how you will pay down any debt and if it's worth consolidating any old pensions

- Put your retirement plan in action and look forward to enjoying your retirement.

- Don't forget to periodically review your plans every year to make sure you're on track, because circumstances can change and the earlier you respond the more time you have to course correct.

DOWNLOAD OUR FREE EXPERT GUIDE

Fancy digging a little deeper on what you need to put in place for a comfortable retirement? Take a look at our free guide.

Download the definitive guide to comfortable retirement planning

Don't miss

Our most popular posts

These are some of our most popular posts. Click below or head over to our blog to see other helpful articles on pensions, retirement and investing.