Posts by Simon Garber

Guide to pension drawdown in 2023

Pension drawdown, like any long-term financial planning and management, is a complex subject, freight with potential risk, and with more people opting to enter pension drawdown; clear guidance is needed. Before April 2015, most people with Defined Contribution pensions were required to buy an annuity—a form of guaranteed income, but since the introduction of pension…

Read MoreWhy are pension transfer values falling?

March 2023, saw defined benefit pension transfer values fall to their lowest month-end level since 2016, far below the record highs we saw in December 2021. And despite some small positive fluctuations, there’s no immediate sign of recovery, with transfer values continuing to fall in the second quarter of 2023. Whilst many factors affect defined…

Read MoreRecommended retirement savings by age

Typically a comfortable retirement is one that allows you to maintain your pre-retirement lifestyle in retirement, so an expert study has set out recommended retirement savings by age based on your annual salary. As a rule of thumb, you should aim to save 10x your salary by the time you reach state retirement age. To…

Read MoreWhat is the Pension Protection Fund?

If you’re a member of a defined benefit pension scheme, you might be worried about what happens to your pension if your scheme or employer goes bust. The good news is that in the vast majority of cases your pension will be protected by the Pension Protection Fund. The Pension Protection Fund (PPF) is a…

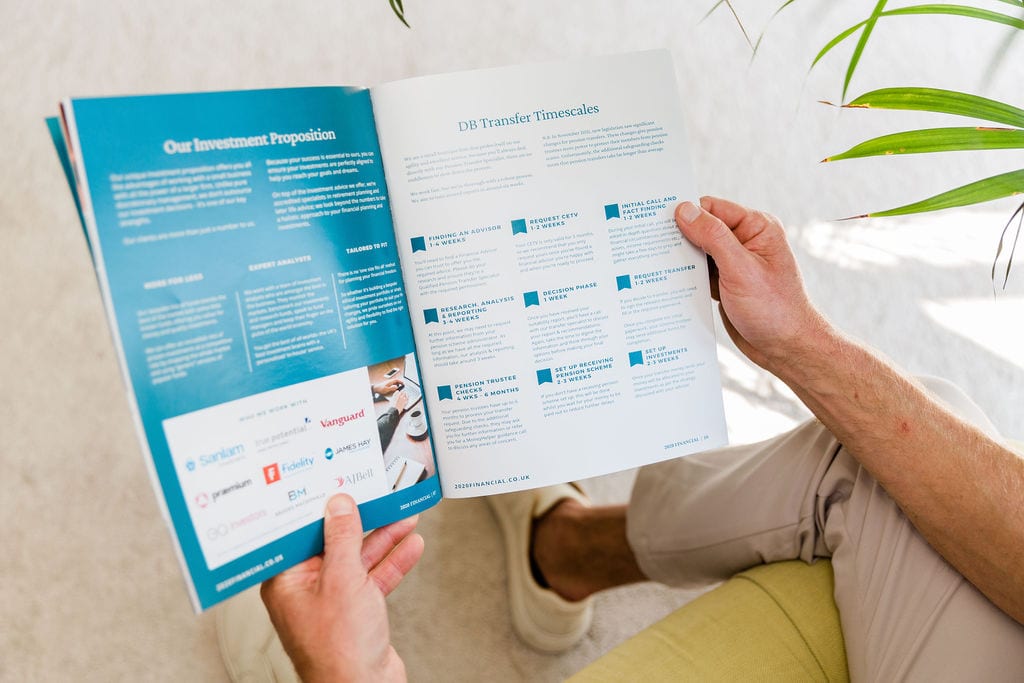

Read MoreDefined benefit pension transfer timescales 2023

Defined Benefit Pension transfer is not a quick process. And Defined benefit pension transfer timescales have increased massively in the past few months. Historically, it could take around 6 months to transfer a Defined Benefit pension. However, legislation requiring enhanced safeguarding checks by scheme trustees has increased the time it takes to transfer your Defined…

Read MoreFreebies & discounts for the over 60s | Retirement discounts

You might still be a few years off the state pension age, but if you’ve just turned 60 you could be taking advantage of some fabulous discounts and freebies. You don’t even need to be retired! The odd few pounds saved here and there can really make a difference over time so it’s definitely worth taking…

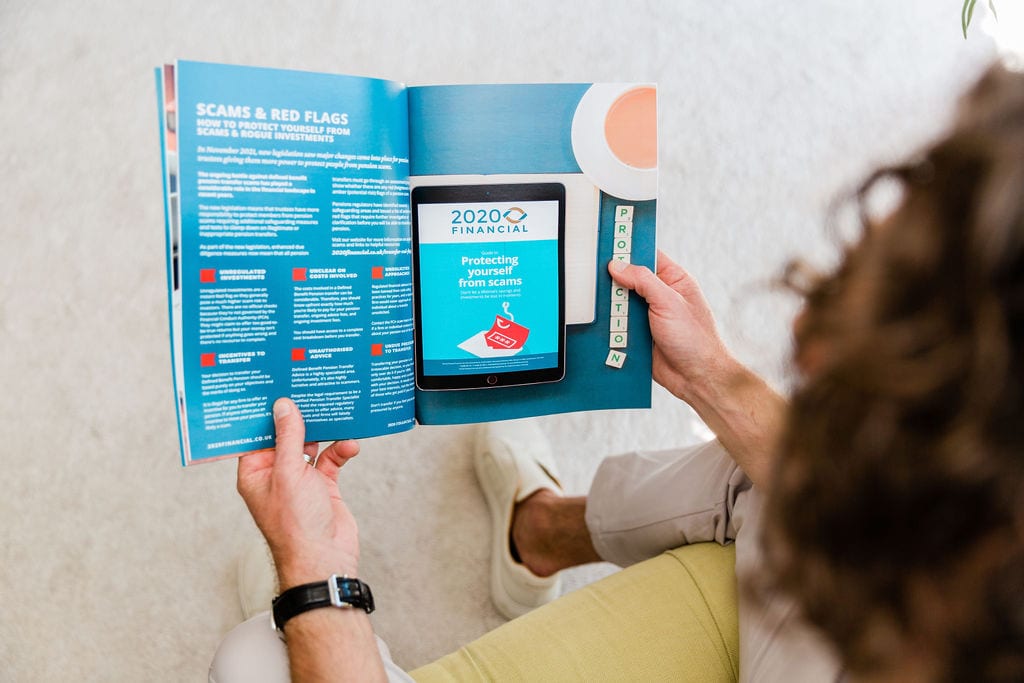

Read MoreDefined Benefit Transfer Warning Flags Explained

Defined Benefit Transfer Warning Flags Explained Transfer Warning Flags can be raised by Defined Benefit pension scheme administrators as part of enhanced safeguarding checks for transfers. Find out what they are, whether you should be concerned and what to do if your pension transfer raises a warning flag: The ongoing battle against defined benefit pension…

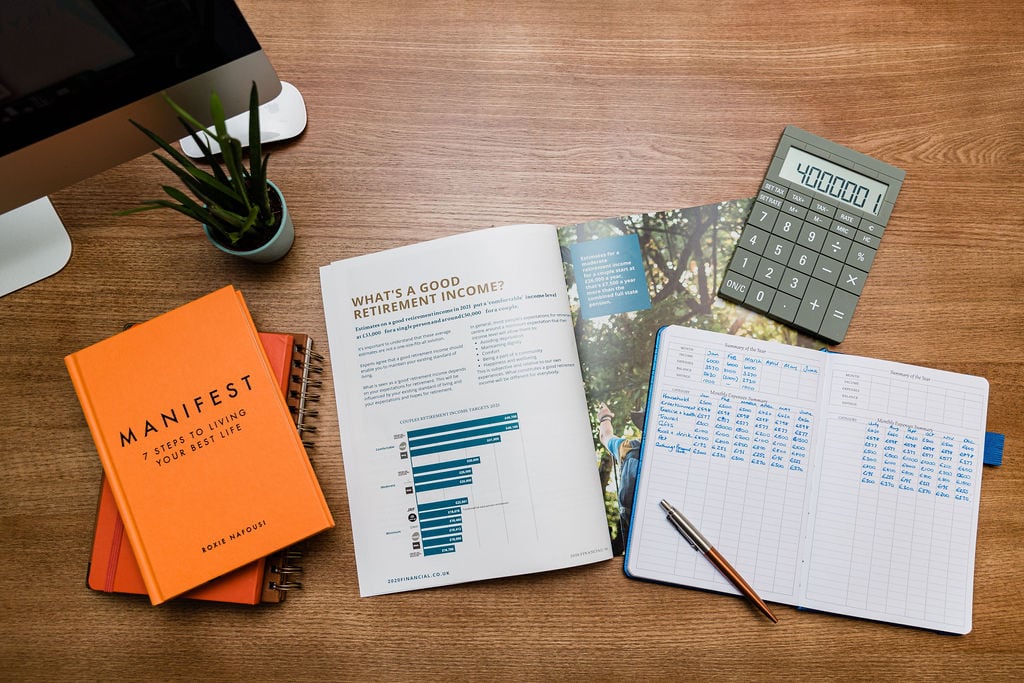

Read MoreHow to budget for retirement

Outlining a budget for retirement is one of the first steps in retirement planning. Without it, it’s impossible to know how much you need to save for the lifestyle you desire. Retirement budgeting and planning are crucial to take the guesswork out of pension planning and set yourself up for a financially stable and stress-free…

Read MoreAre you saving enough for retirement?

Worryingly, research has shown that 90% of all defined contribution pension savers aren’t saving enough to enjoy a comfortable retirement. And since a large majority of us Brits have defined contribution pensions, this suggests that chances are that you aren’t saving enough for retirement. Something that you may not have considered is that this actually…

Read MoreLifestyle Planning: create your dream retirement

A huge amount of retirement planning is based around saving for retirement, building that all-important pension point and then, eventually, working out how much is safe to draw down from your pension. So far so good, right? While these are all crucial elements of your retirement planning, they miss out on one very important component:…

Read MoreEthical Investing Definitions and Types

If you’re considering how to invest your money, Ethical Investing or ESG investing is definitely worth considering. In fact, a meta-study by the University of Oxford showed that companies with better sustainability practices tended to have better operational performance and offer superior stock price performance relative to companies rated lower for ESG. So, not only…

Read MoreIs Lifestyle creep costing you a comfortable retirement?

A comfortable retirement feels like it should be a right of passage. After years of working hard, you want to be able to enjoy your golden years in relative comfort, but if you don’t keep your pre-retirement lifestyle in check, you might find that same lifestyle unattainable post-retirement. It’s easy once we move past the…

Read MoreSocially responsible investing vs ESG

There’s growing pressure on businesses to move towards a more equitable, ethical and sustainable way of operating and in turn for investors, there’s mounting pressure and appetite for socially responsible investing. But what exactly is socially responsible investing and how do you tell the difference between that and its counterparts? When it comes to Socially…

Read MoreWhat is a good retirement income?

Knowing what looks like a good retirement income is one of those tricky retirement planning questions you’ll need to answer. If your retirement is a long way off it can be hard to imagine what that lifestyle will look like for you. The latest Retirement Living Standards data from the PSLA (2023-24) estimates that a…

Read More